Question: a Search the Ch 06 End-of-Chapter Problems - Interest Rates book Suppose the inflation rate is expected to be next year 45 the following year,

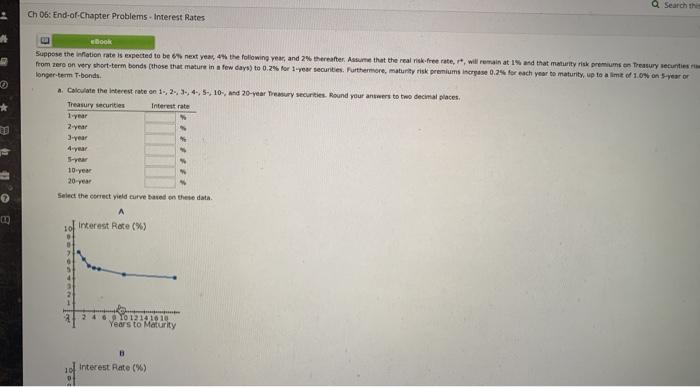

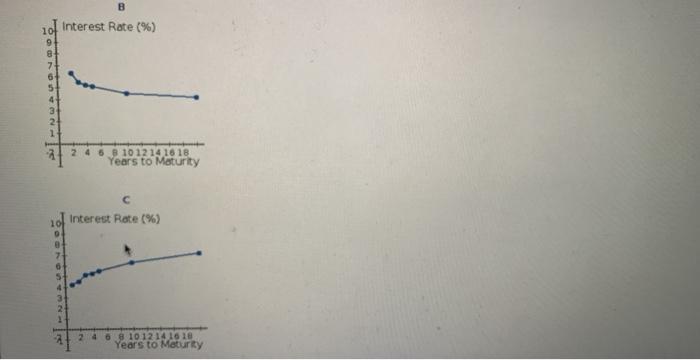

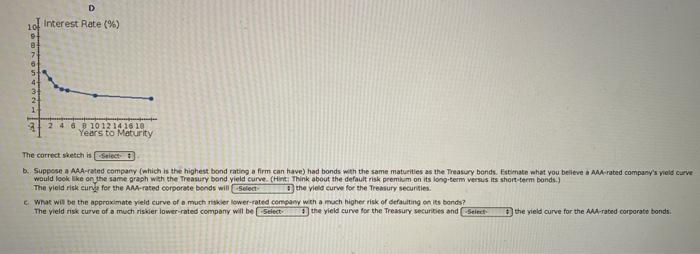

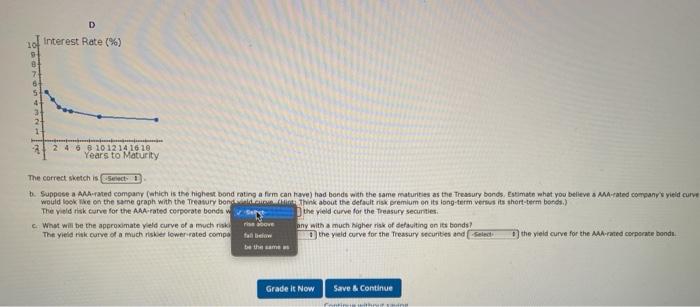

a Search the Ch 06 End-of-Chapter Problems - Interest Rates book Suppose the inflation rate is expected to be next year 45 the following year, and thereafter. Assume that the real free rate will remain at 1 and that maturity risk premiums on Treasury securities from er en very short-term bonds (those that mature in a few days) to 0.25 for 1-year cunties. Furthermore, maturity risk premiums incrase 0.25 for each year to maturity, up to aim of 10% on 5-year or longer-term T-bonds a Calculate the Interest rate on 1, 2, 3, 4, 5, 10, and 20-year Treasury securities. Round your answers to two decimal places Treasury securities Interest rate 1 year 2-year 3-year 4 year -year 10 year 20 year Select the correct yield curve based on these data A 10 Interest Rate (%) 2.46 10 12 14 10 10 Years to Maturity Interest Rate(%) D Interest Rate (%) 107 2 4 6 8 10 12 14 16 10 Years to Maturity The correct sketch is elect b. Suppose a AAA-rated company (which is the highest bood rating a firm can have had bonds with the same maturities as the Treasury bonds. Estimate what you believe a AAA rated company's yield Curve would look like on the same graph with the Treasury bond yield curve. (Hint: Think about the default risk premium on its long-term versus its short-term bonds) The yield risk eurva for the AAA-rated corporate bonds will select the yield curve for the Treasury securities What will be the approximate yield curve of a much risker lower-rated company with a much higher risk of defaulting on its bonds? The yield nisk curve of a much risker lower-rated company will be Select the yield curve for the Treasury securities and Select the yield curve for the MM-rated corporate bonds D Interest Rate (%) 2 2 24 09 10 12 14 10 10 Years to Maturity The correct sketch Self . Suppose AA by (which is the highest bond rating a firm can have had bonds with the same maturities as the Treasury bonds. Estimate what you believe a Mrated company's vied cur would look like graph with the Treasury bord yield curve. (Hint: Think about the default risk premium on its long-term venus its short-term bonds) The yield risk c A rated corporate bonds wil Select the yield curve for the Treasury securities What will be the D yield curve of a much risker lower rated company with a much higher risk of defaulting on its bonds? The yield risk och sker lower rated company will be select the yield curve for the Treasury securities and Serled the yield curve for the AAA-rated corporate bonde D Interest Rate (%) 2 4 6 8 10 12 14 16 10 Years to Maturity The correct sketch is rect Suppose a AAA-rated company (which is the highest bond rating a firm can have had bonds with the same maturities as the Treasury bonds Estimate what you believe a MA-rated company's yield curve would look like on the same graph with the Treasury bonded in think about the default risk premium on its long-term versus its short-term bons.) The yield risk turve for the AAA rated corporate bonds the yield curve for the Treasury securities c. What will be the approximate yield curve of a much riske reve any with a much Nigher risk of defaulting on its bonds? The yield risk curve of a much risker lower rated compo the yield curve for the Treasury securities and select the yield curve for the framed corporate bonds be the same Grade it Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts