Question: A SECURED INTEREST AND NO SECURITY INTEREST IS WRONG Case Problem Analysis: Secured Transactions Mikhail and Dana Jackson, doing business as M&D Enterprises, Inc., bought

A SECURED INTEREST AND NO SECURITY INTEREST IS WRONG

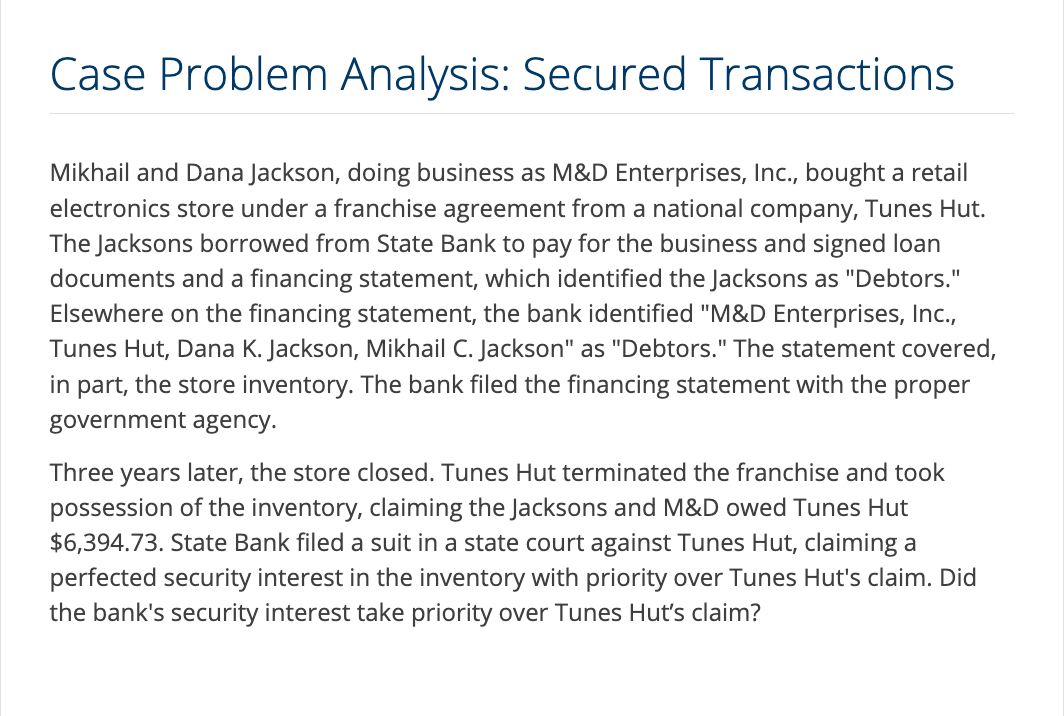

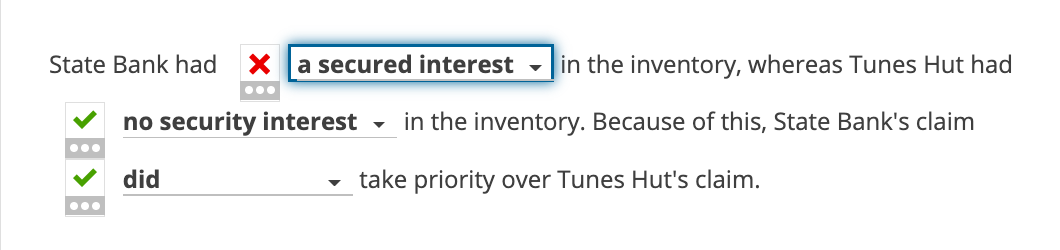

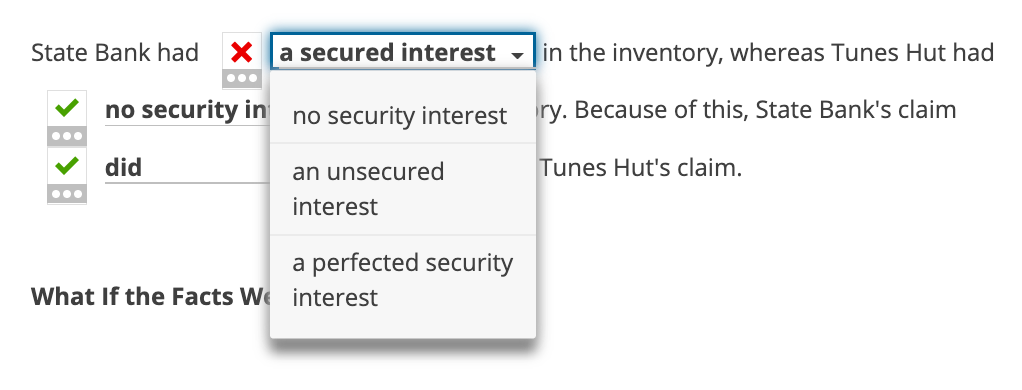

Case Problem Analysis: Secured Transactions Mikhail and Dana Jackson, doing business as M&D Enterprises, Inc., bought a retail electronics store under a franchise agreement from a national company, Tunes Hut. The Jacksons borrowed from State Bank to pay for the business and signed loan documents and a financing statement, which identified the Jacksons as "Debtors." Elsewhere on the financing statement, the bank identified "M&D Enterprises, Inc., Tunes Hut, Dana K. Jackson, Mikhail C. Jackson" as "Debtors." The statement covered, in part, the store inventory. The bank filed the financing statement with the proper government agency. Three years later, the store closed. Tunes Hut terminated the franchise and took possession of the inventory, claiming the Jacksons and M&D owed Tunes Hut $6,394.73. State Bank filed a suit in a state court against Tunes Hut, claiming a perfected security interest in the inventory with priority over Tunes Hut's claim. Did the bank's security interest take priority over Tunes Hut's claim? State Bank had X a secured interest in the inventory, whereas Tunes Hut had no security interest in the inventory. Because of this, State Bank's claim did take priority over Tunes Hut's claim. State Bank had X a secured interest no security interest no security in did an unsecured interest a perfected security What If the Facts We interest in the inventory, whereas Tunes Hut had ry. Because of this, State Bank's claim Tunes Hut's claim. Case Problem Analysis: Secured Transactions Mikhail and Dana Jackson, doing business as M&D Enterprises, Inc., bought a retail electronics store under a franchise agreement from a national company, Tunes Hut. The Jacksons borrowed from State Bank to pay for the business and signed loan documents and a financing statement, which identified the Jacksons as "Debtors." Elsewhere on the financing statement, the bank identified "M&D Enterprises, Inc., Tunes Hut, Dana K. Jackson, Mikhail C. Jackson" as "Debtors." The statement covered, in part, the store inventory. The bank filed the financing statement with the proper government agency. Three years later, the store closed. Tunes Hut terminated the franchise and took possession of the inventory, claiming the Jacksons and M&D owed Tunes Hut $6,394.73. State Bank filed a suit in a state court against Tunes Hut, claiming a perfected security interest in the inventory with priority over Tunes Hut's claim. Did the bank's security interest take priority over Tunes Hut's claim? State Bank had X a secured interest in the inventory, whereas Tunes Hut had no security interest in the inventory. Because of this, State Bank's claim did take priority over Tunes Hut's claim. State Bank had X a secured interest no security interest no security in did an unsecured interest a perfected security What If the Facts We interest in the inventory, whereas Tunes Hut had ry. Because of this, State Bank's claim Tunes Hut's claim

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts