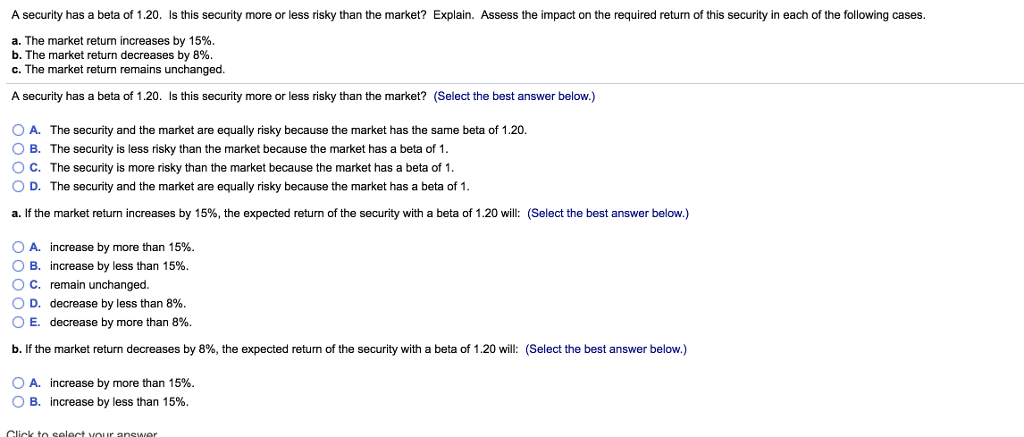

Question: A security has a beta of 20. Is this security more or less risky than the market? Explain. Assess the impact on the required returm

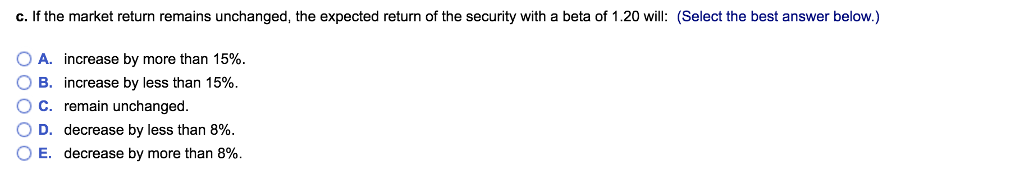

A security has a beta of 20. Is this security more or less risky than the market? Explain. Assess the impact on the required returm of this security in each of the following cases. a. The market retum increases by 15%. b. The market return decreases by 8%. c. The market return remains unchanged. A security has a beta of 1.20. Is this security more or less risky than the market? (Select the best answer below.) OA. The security and the market are equally risky because the market has the same beta of 1.20. O B. The security is less risky than the market because the market has a beta of 1 C. The security is more risky than the market because the market has a beta of 1 0 D. The security and the market are equally risky because the market has a beta of 1 a. If the market return increases by 15%, the expected return of the security with a beta of 1.20 will: (Select the best answer below.) O A. increase by more than 15%. O B. increase by less than 15% O C. remain unchanged. O D. decrease by less than 896. O E. decrease by more than 896. b. If the market return decreases by 8%, the expected return of the security with a beta of 1.20 will Select the best answer below. A. O B. increase by more than 15%. increase by less than 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts