Question: A security is currently trading at $96. It will pay a coupon of $4 in three months. No other payouts are expected in the

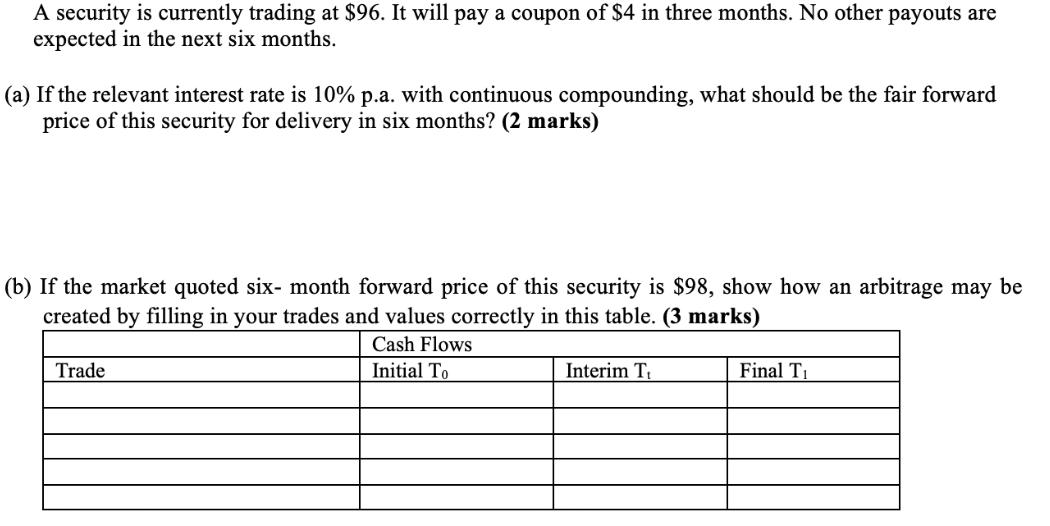

A security is currently trading at $96. It will pay a coupon of $4 in three months. No other payouts are expected in the next six months. (a) If the relevant interest rate is 10% p.a. with continuous compounding, what should be the fair forward price of this security for delivery in six months? (2 marks) (b) If the market quoted six- month forward price of this security is $98, show how an arbitrage may be created by filling in your trades and values correctly in this table. (3 marks) Trade Cash Flows Initial To Interim T. Final T

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

a Fair forward price in 6 months Present value of 4 coupon received in 3 months 4e01025 396 Presen... View full answer

Get step-by-step solutions from verified subject matter experts