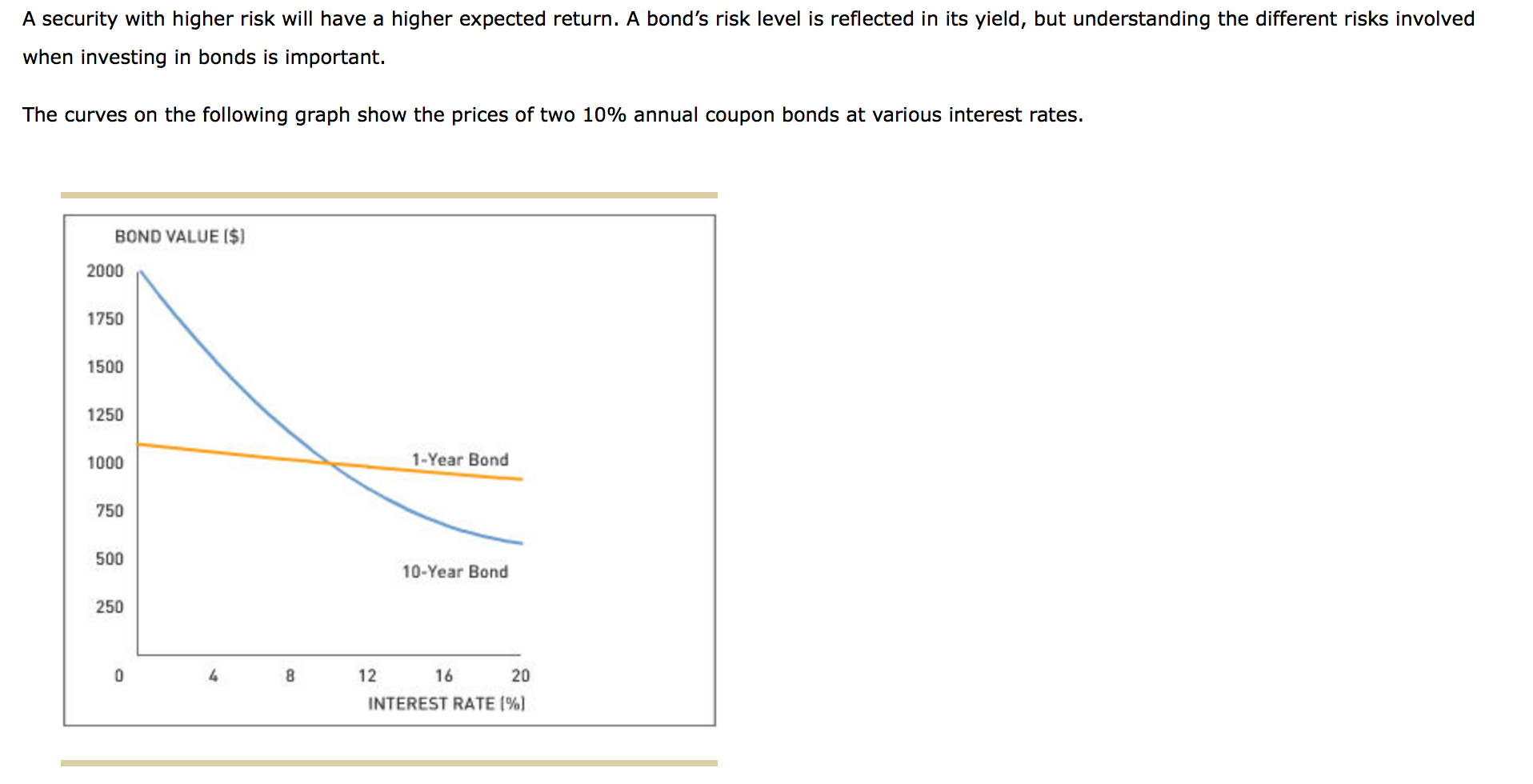

Question: A security with higher risk will have a higher expected return. A bond's risk level is reflected in its yield, but understanding the different risks

A security with higher risk will have a higher expected return. A bond's risk level is reflected in its yield, but understanding the different risks involved when investing in bonds is important. The curves on the following graph show the prices of two 10% annual coupon bonds at various interest rates. BOND VALUE ($1 2000 1750 1500 1250 1000 1-Year Bond 750 500 10-Year Bond 250 0 4 8 12 16 20 INTEREST RATE [%] Based on the graph, which of the following statements is true? Neither bond has any interest rate risk. The 1-year bond has more interest rate risk. Both bonds have equal interest rate risk. The 10-year bond has more interest rate risk. Which type of bonds offer a higher yield? Callable bonds o o Noncallable bonds Answer the following question based on your understanding of interest rate risk and reinvestment risk. True or False: Assuming all else is equal, the shorter a bond's maturity, the more its price will change in response to a given change in interest rates. False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts