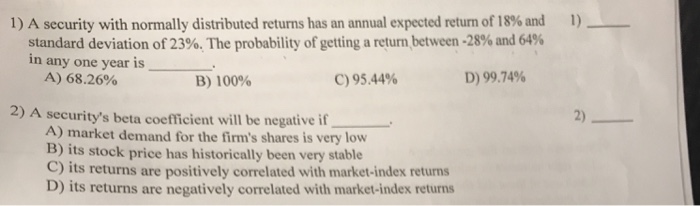

Question: A security with normally distributed returns has an annual expected return of 18% and standard deviation of 23%. The probability of getting a return between

A security with normally distributed returns has an annual expected return of 18% and standard deviation of 23%. The probability of getting a return between - 28% and 64% in any one year is _____. A) 68.26% B) 100% C) 95.44% D) 99.74% A security's beta coefficient will be negative if _______. A) market demand for the firm's shares is very low B) its stock price has historically been very stable C) its returns are positively correlated with market-index returns D) its returns are negatively correlated with market-index returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts