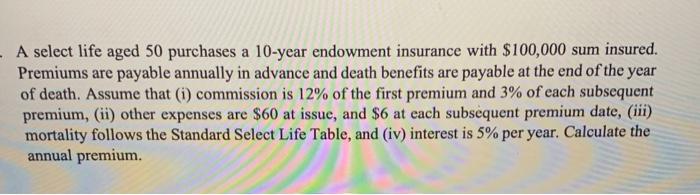

Question: - A select life aged 50 purchases a 10-year endowment insurance with $100,000 sum insured. Premiums are payable annually in advance and death benefits are

- A select life aged 50 purchases a 10-year endowment insurance with $100,000 sum insured. Premiums are payable annually in advance and death benefits are payable at the end of the year of death. Assume that (1) commission is 12% of the first premium and 3% of each subsequent premium, (ii) other expenses are $60 at issue, and $6 at each subsequent premium date, (iii) mortality follows the Standard Select Life Table, and (iv) interest is 5% per year. Calculate the annual premium. - A select life aged 50 purchases a 10-year endowment insurance with $100,000 sum insured. Premiums are payable annually in advance and death benefits are payable at the end of the year of death. Assume that (1) commission is 12% of the first premium and 3% of each subsequent premium, (ii) other expenses are $60 at issue, and $6 at each subsequent premium date, (iii) mortality follows the Standard Select Life Table, and (iv) interest is 5% per year. Calculate the annual premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts