Question: A service company is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value. The

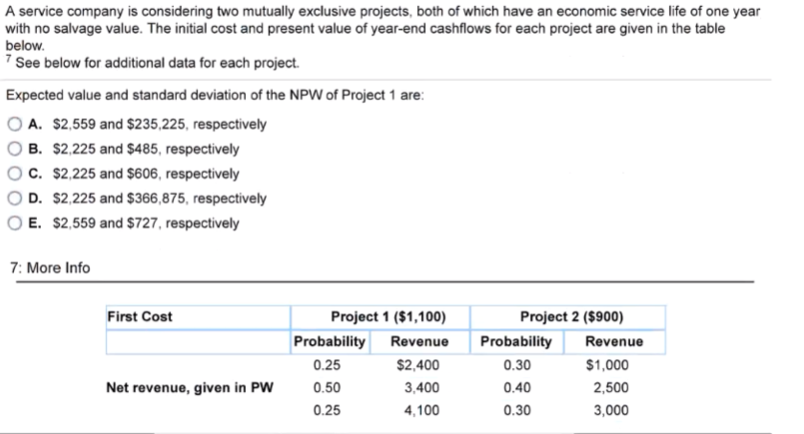

A service company is considering two mutually exclusive projects, both of which have an economic service life of one year with no salvage value. The initial cost and present value of year-end cashflows for each project are given in the table below. 7 See below for additional data for each project. Expected value and standard deviation of the NPW of Project 1 are: O A. $2,559 and $235,225, respectively B. $2,225 and $485, respectively C. $2,225 and $606, respectively D. $2,225 and $366,875, respectively O E. $2,559 and $727, respectively 7: More Info First Cost Project 1 ($1,100) Probability Revenue 0.25 $2,400 0.50 3,400 0.25 4,100 Project 2 ($900) Probability Revenue 0.30 $1,000 0.40 2,500 0.30 3,000 Net revenue, given in PW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts