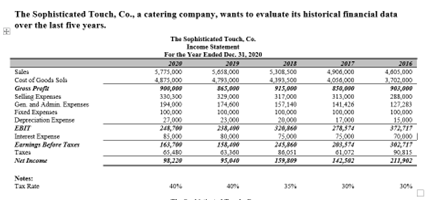

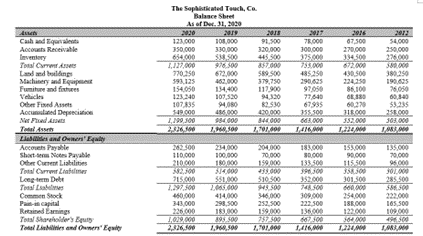

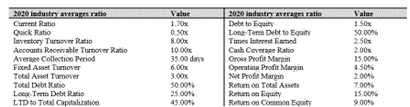

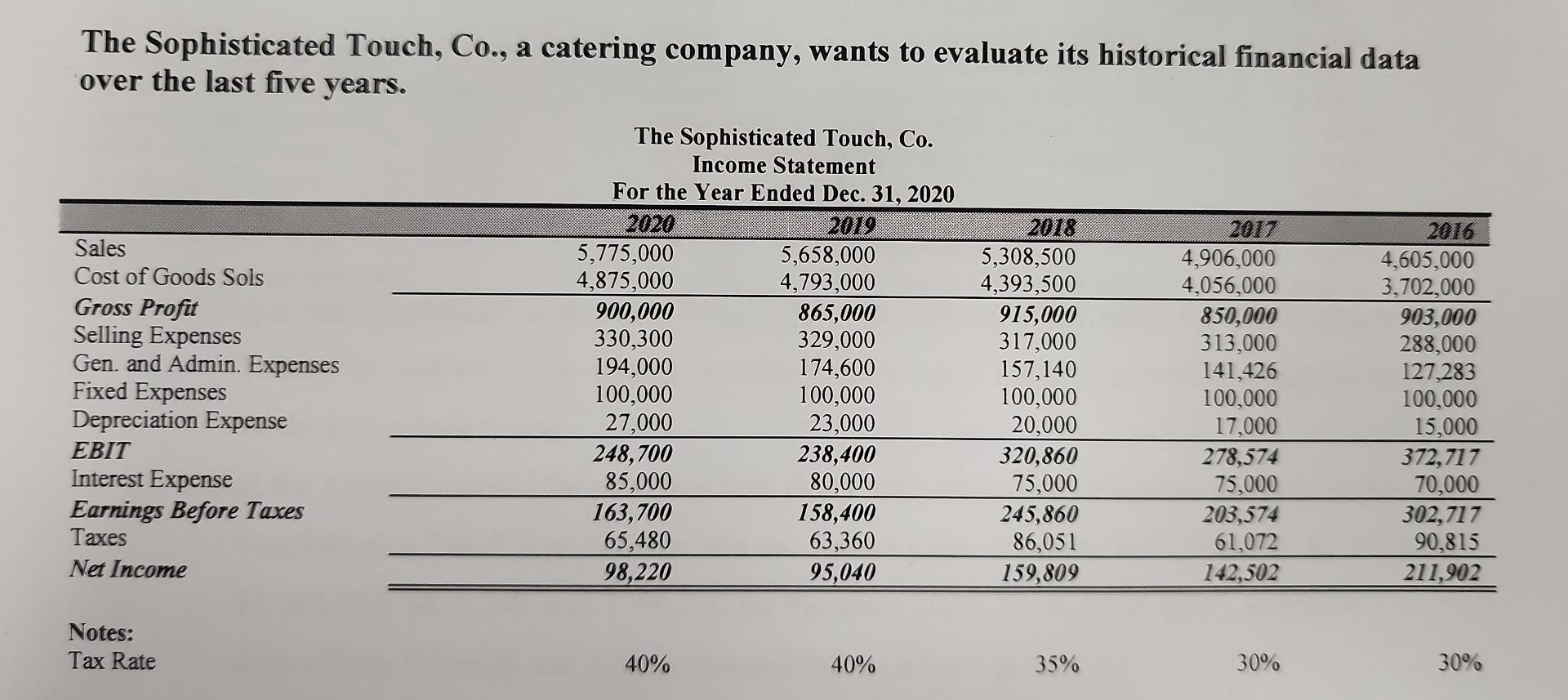

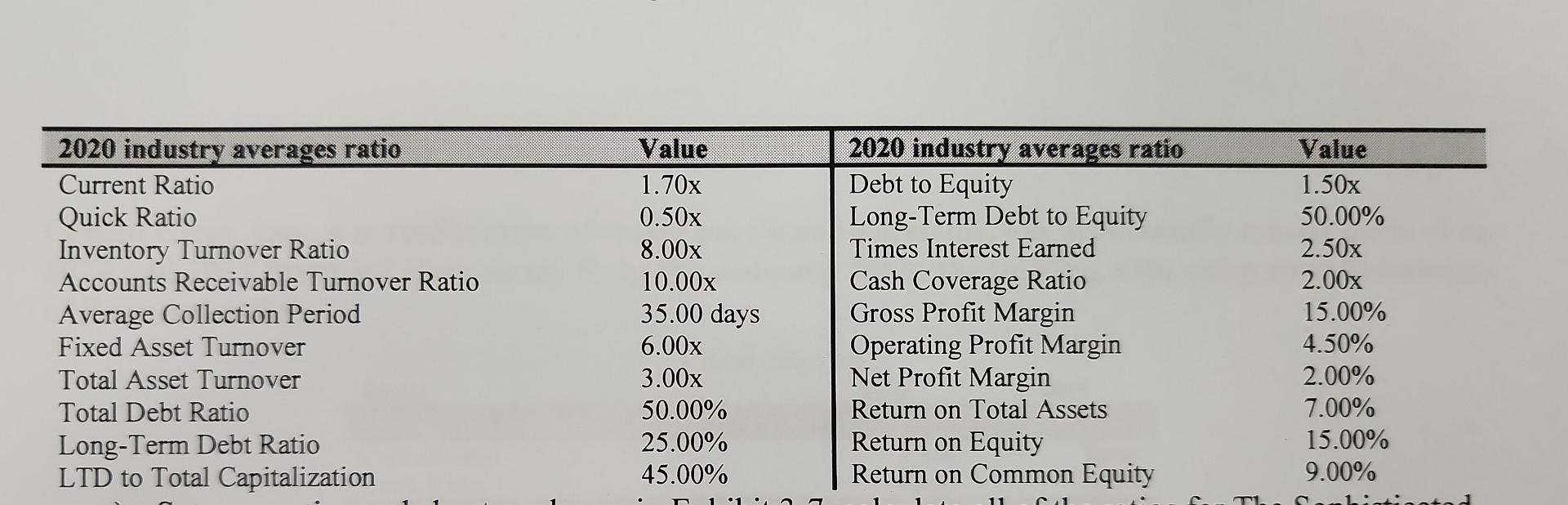

Question: A.) Set up a ratio worksheet as shown in Exhibit 3-7, calculate all of the ratios for The Sophisticated Touch, Co, and verify the change

A.) Set up a ratio worksheet as shown in Exhibit 3-7, calculate all of the ratios for The Sophisticated Touch, Co, and verify the change in 2020 Sophisticated Touch, Co.s ROE using the Du Pont method (Analysis 4 pts).

B.) Using the Altmans model for privately held firms and public ones, calculate the Z-score for The Sophisticated Touch, Co. Assume that the market value of equity is $1,500,000; $1,250,000; $1,000,000; $850,000; and $700,000 for the years 2020, 2019, 2018, 2017, and 2016 respectively (Identify and Access Needed Information 4 pts).

C.) Complete & calculate the economic profits and other related information for these years and compare it to net income. Assume that the WACC is 12% each year (Identify and Access Needed Information 4 pts).

D.) The staff at The Sophisticated Touch, Co. wants to perform a trend analysis with the data generated in the previous sections of this problem. Create a line chart showing each category of ratios from 2016 to 2020. Make sure to title the chart and label the axes. Also make a line chart of the Altmans model for private and public firms from 2016 to 2020 (Use Information Effectively to Accomplish a Specific Purpose 4 pts).

E.) Interpretation: please describe where you obtained information to develop analyses and interpret the results.

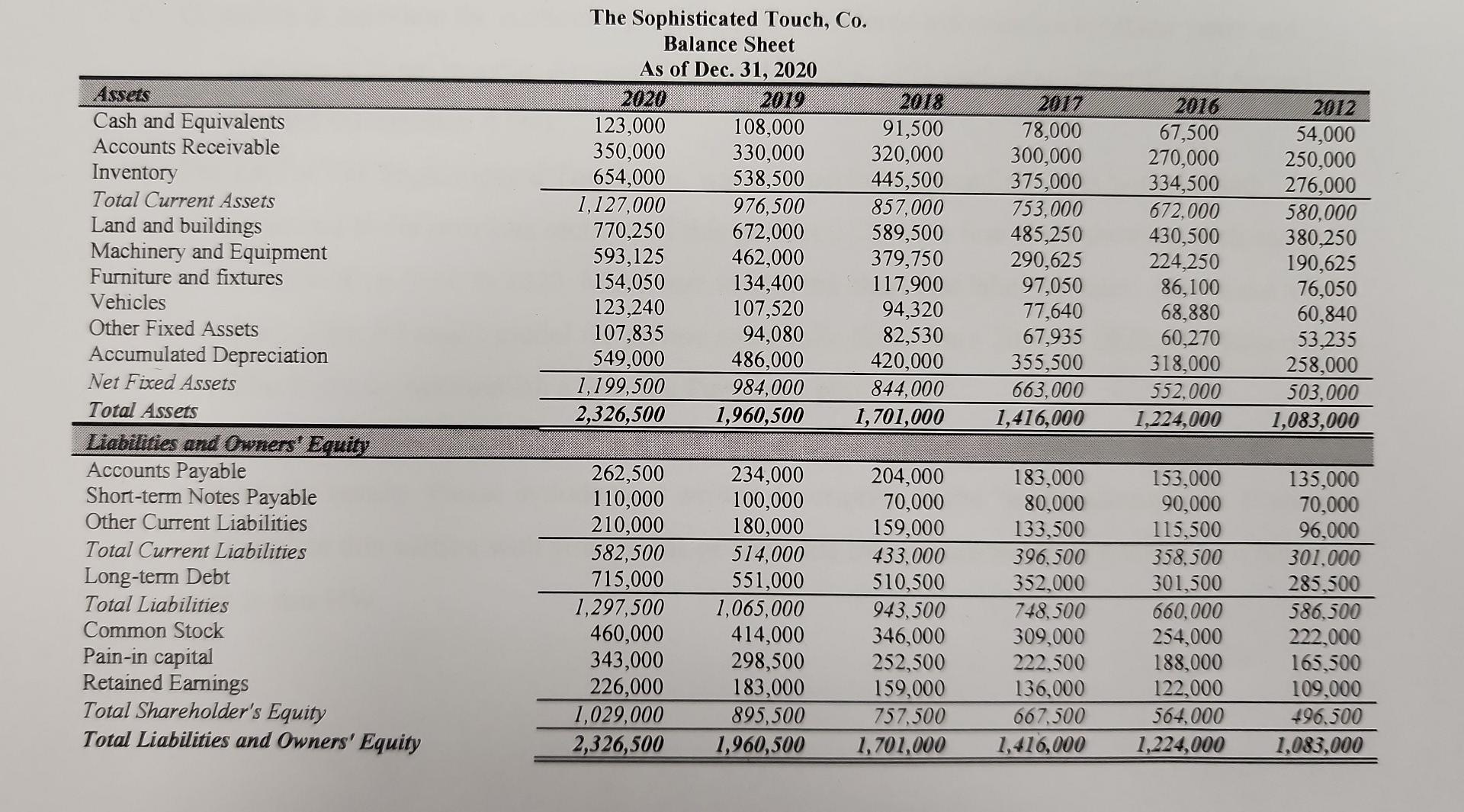

The Sophisticated Touch, Co-, a catering company, wants to evaluate its histerical financial data over the last five years. The Sopbkthated Touch, Ca. Balaace Sbret The Sophisticated Touch, Co., a catering company, wants to evaluate its historical financial data The Sophisticated Touch, Co. Balance Sheet As of Dec. 31, 2020 \begin{tabular}{ll|lc} \hline 2020 industry averages ratio & Value & 2020 industry averages ratio & Value \\ \hline Current Ratio & 1.70x & Debt to Equity & 1.50x \\ Quick Ratio & 0.50x & Long-Term Debt to Equity & 50.00% \\ Inventory Turnover Ratio & 8.00x & Times Interest Earned & 2.50x \\ Accounts Receivable Turnover Ratio & 10.00x & Cash Coverage Ratio & 2.00x \\ Average Collection Period & 35.00 days & Gross Profit Margin & 15.00% \\ Fixed Asset Turnover & 6.00x & Operating Profit Margin & 4.50% \\ Total Asset Turnover & 3.00x & Net Profit Margin & 2.00% \\ Total Debt Ratio & 50.00% & Return on Total Assets & 7.00% \\ Long-Term Debt Ratio & 25.00% & Return on Equity & 15.00% \\ LTD to Total Capitalization & 45.00% & Return on Common Equity \end{tabular} The Sophisticated Touch, Co-, a catering company, wants to evaluate its histerical financial data over the last five years. The Sopbkthated Touch, Ca. Balaace Sbret The Sophisticated Touch, Co., a catering company, wants to evaluate its historical financial data The Sophisticated Touch, Co. Balance Sheet As of Dec. 31, 2020 \begin{tabular}{ll|lc} \hline 2020 industry averages ratio & Value & 2020 industry averages ratio & Value \\ \hline Current Ratio & 1.70x & Debt to Equity & 1.50x \\ Quick Ratio & 0.50x & Long-Term Debt to Equity & 50.00% \\ Inventory Turnover Ratio & 8.00x & Times Interest Earned & 2.50x \\ Accounts Receivable Turnover Ratio & 10.00x & Cash Coverage Ratio & 2.00x \\ Average Collection Period & 35.00 days & Gross Profit Margin & 15.00% \\ Fixed Asset Turnover & 6.00x & Operating Profit Margin & 4.50% \\ Total Asset Turnover & 3.00x & Net Profit Margin & 2.00% \\ Total Debt Ratio & 50.00% & Return on Total Assets & 7.00% \\ Long-Term Debt Ratio & 25.00% & Return on Equity & 15.00% \\ LTD to Total Capitalization & 45.00% & Return on Common Equity \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts