Question: a Show the journal entry to record the initial revaluation. b Show the journal entries to record the depreciation for each of the years ended

a Show the journal entry to record the initial revaluation.

b Show the journal entries to record the depreciation for each of the years ended 30 June 2018 to 2021

Record depreciation for the year ended 30 June .2018

c. Show the journal entry to record the revaluation on 30 June 2021.

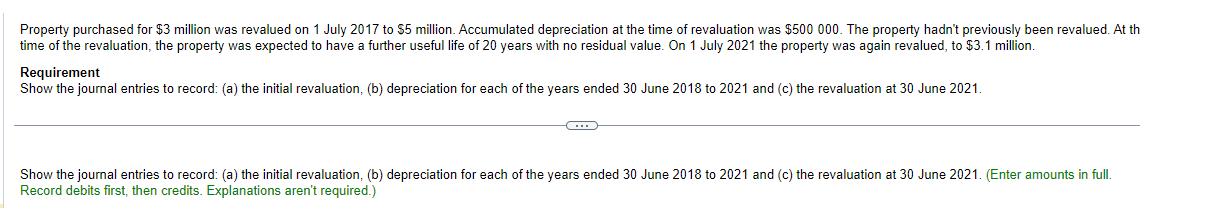

Property purchased for $3 million was revalued on 1 July 2017 to $5 million. Accumulated depreciation at the time of revaluation was $500 000. The property hadn't previously been revalued. At th time of the revaluation, the property was expected to have a further useful life of 20 years with no residual value. On 1 July 2021 the property was again revalued, to $3.1 million. Requirement Show the journal entries to record: (a) the initial revaluation, (b) depreciation for each of the years ended 30 June 2018 to 2021 and (c) the revaluation at 30 June 2021. C Show the journal entries to record: (a) the initial revaluation, (b) depreciation for each of the years ended 30 June 2018 to 2021 and (c) the revaluation at 30 June 2021. (Enter amounts in full. Record debits first, then credits. Explanations aren't required.)

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

a Initial Revaluation Debit Property Revaluation Reserve 2000000 5000000 3000000 ... View full answer

Get step-by-step solutions from verified subject matter experts