Question: a) Sima Inc. will pay $1 dividend for the next three years and then the dividend will grow at 10% per year indefinitely. If required

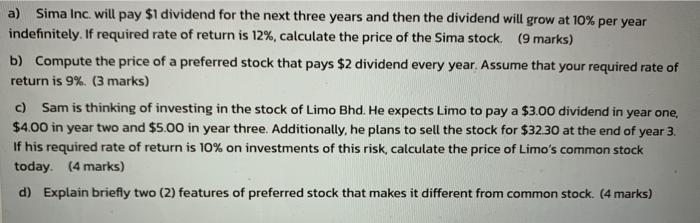

a) Sima Inc. will pay $1 dividend for the next three years and then the dividend will grow at 10% per year indefinitely. If required rate of return is 12%, calculate the price of the Sima stock. (9 marks) b) Compute the price of a preferred stock that pays $2 dividend every year. Assume that your required rate of return is 9% (3 marks) c) Sam is thinking of investing in the stock of Limo Bhd. He expects Limo to pay a $3.00 dividend in year one, $4.00 in year two and $5.00 in year three Additionally, he plans to sell the stock for $3230 at the end of year 3. If his required rate of return is 10% on investments of this risk, calculate the price of Limo's common stock today. (4 marks) d) Explain briefly two (2) features of preferred stock that makes it different from common stock. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts