Question: A simple collateralised debt obligation (CDO) is securitised from a pool of loans with face value 1 million and overall rate of return of 6%.

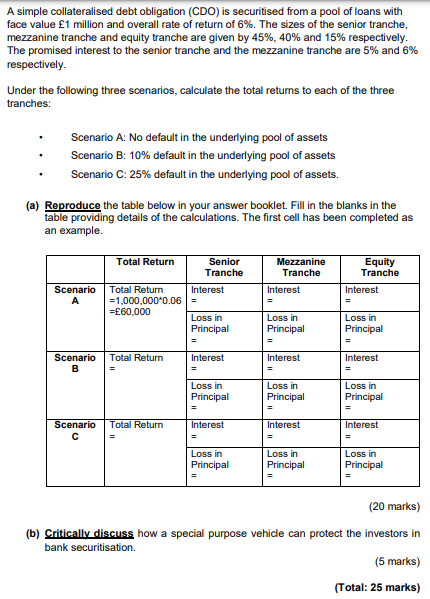

A simple collateralised debt obligation (CDO) is securitised from a pool of loans with face value 1 million and overall rate of return of 6%. The sizes of the senior tranche, mezzanine tranche and equity tranche are given by 45%, 40% and 15% respectively The promised interest to the senior tranche and the mezzanine tranche are 5% and 6% respectively. Under the following three scenarios, calculate the total returns to each of the three tranches: Scenario A: No default in the underlying pool of assets Scenario B: 10% default in the underlying pool of assets Scenario C: 25% default in the underlying pool of assets. (a) Reproduce the table below in your answer booklet. Fill in the blanks in the table providing details of the calculations. The first cell has been completed as an example. Mezzanine Tranche Interest Equity Tranche Interest Total Return Senior Tranche Total Return Interest =1,000,000*0.06 = =60,000 Loss in Principal Scenario A Loss in Principal Loss in Principal = Scenario B Total Return Interest = Interest Interest Loss in Principal Loss in Principal Loss in Principal Scenario Total Return Interest = Interest Interest C Loss in Principal Loss in Principal Loss in Principal (20 marks) (b) Critically discuss how a special purpose vehicle can protect the investors in bank securitisation. (5 marks) (Total: 25 marks) A simple collateralised debt obligation (CDO) is securitised from a pool of loans with face value 1 million and overall rate of return of 6%. The sizes of the senior tranche, mezzanine tranche and equity tranche are given by 45%, 40% and 15% respectively The promised interest to the senior tranche and the mezzanine tranche are 5% and 6% respectively. Under the following three scenarios, calculate the total returns to each of the three tranches: Scenario A: No default in the underlying pool of assets Scenario B: 10% default in the underlying pool of assets Scenario C: 25% default in the underlying pool of assets. (a) Reproduce the table below in your answer booklet. Fill in the blanks in the table providing details of the calculations. The first cell has been completed as an example. Mezzanine Tranche Interest Equity Tranche Interest Total Return Senior Tranche Total Return Interest =1,000,000*0.06 = =60,000 Loss in Principal Scenario A Loss in Principal Loss in Principal = Scenario B Total Return Interest = Interest Interest Loss in Principal Loss in Principal Loss in Principal Scenario Total Return Interest = Interest Interest C Loss in Principal Loss in Principal Loss in Principal (20 marks) (b) Critically discuss how a special purpose vehicle can protect the investors in bank securitisation. (5 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts