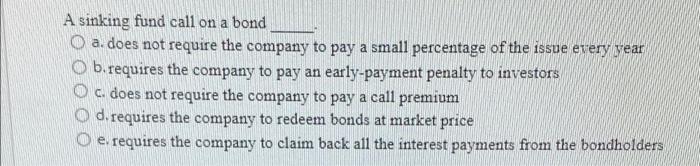

Question: A sinking fund call on a bond O a. does not require the company to pay a small percentage of the issue every year O

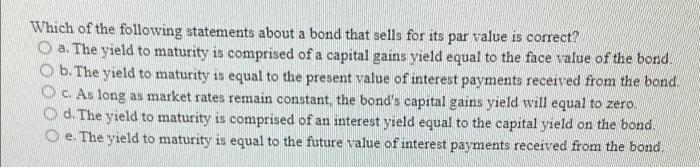

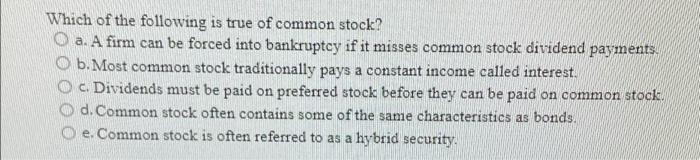

A sinking fund call on a bond O a. does not require the company to pay a small percentage of the issue every year O b.requires the company to pay an early-payment penalty to investors O c does not require the company to pay a call premium O d. requires the company to redeem bonds at market price O e requires the company to claim back all the interest payments from the bondholders Which of the following statements about a bond that sells for its par value is correct? O a. The yield to maturity is comprised of a capital gains yield equal to the face value of the bond O b. The yield to maturity is equal to the present value of interest payments received from the bond O c. As long as market rates remain constant, the bond's capital gains yield will equal to zero. od. The yield to maturity is comprised of an interest yield equal to the capital yield on the bond O e. The yield to maturity is equal to the future value of interest payments received from the bond Which of the following is true of common stock? O a. A firm can be forced into bankruptcy if it misses common stock dividend payments. O b. Most common stock traditionally pays a constant income called interest. c. Dividends must be paid on preferred stock before they can be paid on common stock. d. Common stock often contains some of the same characteristics as bonds. O e. Common stock is often referred to as a hybrid security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts