Question: A ski resort is being planned for Eureka, MO. The expenditures for the first four years are expected to be Year 0. Land acquisition and

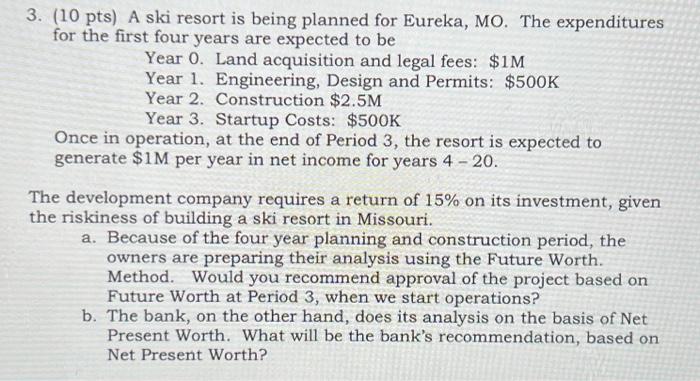

3. (10 pts) A ski resort is being planned for Eureka, MO. The expenditures for the first four years are expected to be Year 0. Land acquisition and legal fees: \$1M Year 1. Engineering, Design and Permits: $500K Year 2. Construction $2.5M Year 3. Startup Costs: $500K Once in operation, at the end of Period 3, the resort is expected to generate $1M per year in net income for years 420. The development company requires a return of 15% on its investment, given the riskiness of building a ski resort in Missouri. a. Because of the four year planning and construction period, the owners are preparing their analysis using the Future Worth. Method. Would you recommend approval of the project based on Future Worth at Period 3, when we start operations? b. The bank, on the other hand, does its analysis on the basis of Net Present Worth. What will be the bank's recommendation, based on Net Present Worth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts