Question: A small manufacturer is considering two alternative machines. Machine A costs $10,000, has an expected life of 5 years, and generates cash flows of $3,500

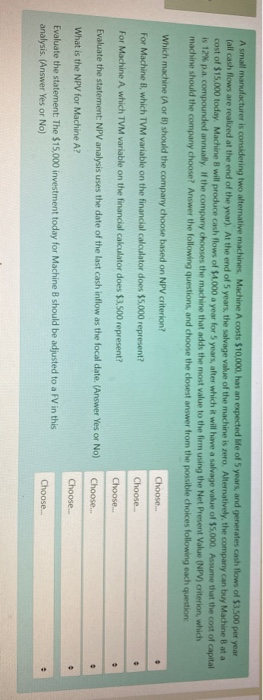

A small manufacturer is considering two alternative machines. Machine A costs $10,000, has an expected life of 5 years, and generates cash flows of $3,500 per year (all cash flows are realized at the end of the year). At the end of 5 years, the salvage value of the machine is zero. Alternatively, the company can buy Machine B at a cost of $15.000 today. Machine I will produce cash flows of $1.000 a year for 5 years, after which it will have a salvage value of $5.000. Assume that the cost of capital is 12% pa. compounded annually. If the company chooses the machine that adds the most value to the firm using the Net Present Value (NPV) criterion, which machine should the company choose? Answer the following questions, and choose the closest answer from the possible choices following each questione Which machine (A or B) should the company choose based on NPV criterion? Choose For Machine B, which TVM variable on the financial calculator does $5.000 represent? For Machine A which TVM variable on the financial calculator does $3,500 represent? Choose. . Choose... Evaluate the statement: NPV analysis uses the date of the last cash inflow as the focal date. (Answer Yes or No) Choose What is the NPV for Machine A? Choose.. Evaluate the statement: The $15,000 investment today for Machine B should be adjusted to a FV in this analysis. (Answer Yes or No) Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts