Question: A solve problem Home Chegg.com C https:// com assignmen 26768 problemNo 7 accep /solve? Accep My courses BUS 307 HWK 10- Ch 13 Intro Union

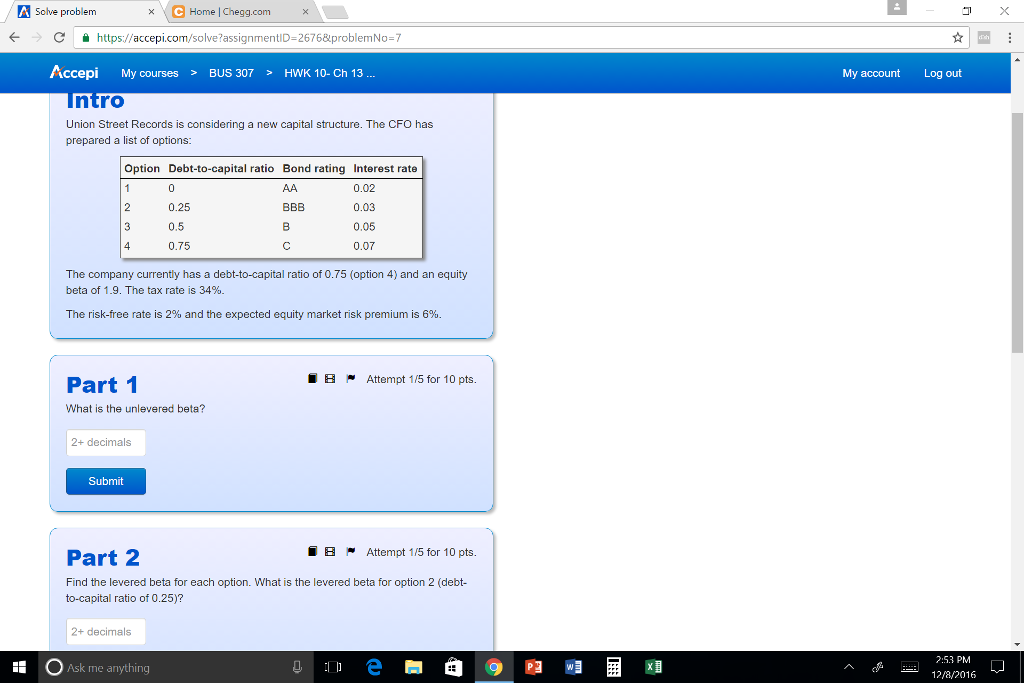

A solve problem Home Chegg.com C https:// com assignmen 26768 problemNo 7 accep /solve? Accep My courses BUS 307 HWK 10- Ch 13 Intro Union Street Records is considering a new capital structure. The CFO has prepared a list of options: Option Debt-to-capital ratio Bond rating interest rate 0.02 0.25 0.03 0.05 0.5 0.75 0.07 The company currently has a debt-to-capital ratio of 0.75 (option 4) and an equity beta of 1.9. The tax rate is 34%. The risk-free rate is 2% and the expected equity market risk premium is 6%. B Attempt 1/5 for 10 pts. Part 1 What is the unlevered beta? 2 decimals Submit B M Attempt 1/5 for 10 pts. Part 2 Find the levered beta for each option. What is the levered beta for option 2 (debt- to-capital ratio of 0.25)? 2 decimals Ask me anything I My account Log out 2:53 PM 2/8/2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts