Question: A special-purpose machine tool set would cost $20,000. The tool set will be financed by a $10,000 bank loan repayable in two equal annual installments

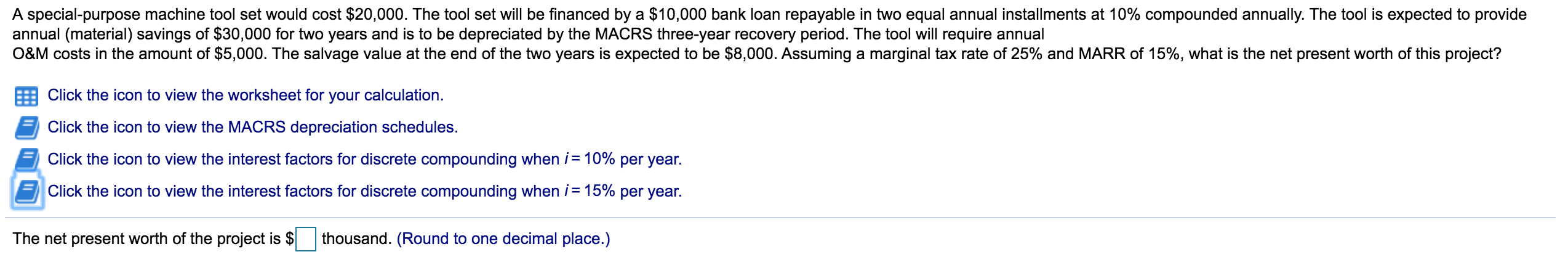

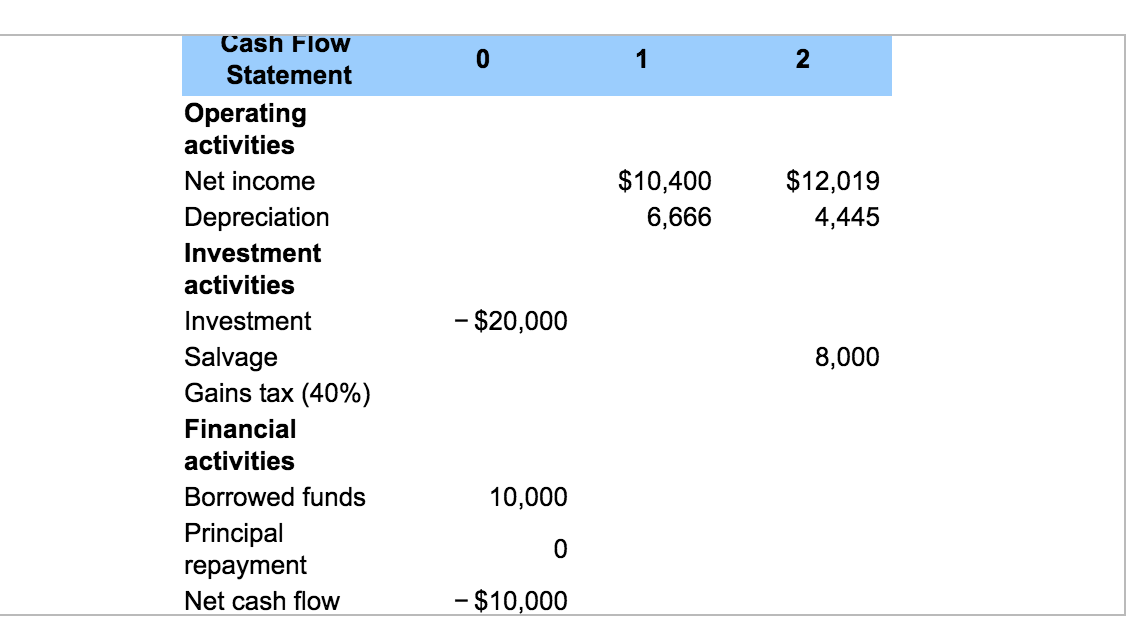

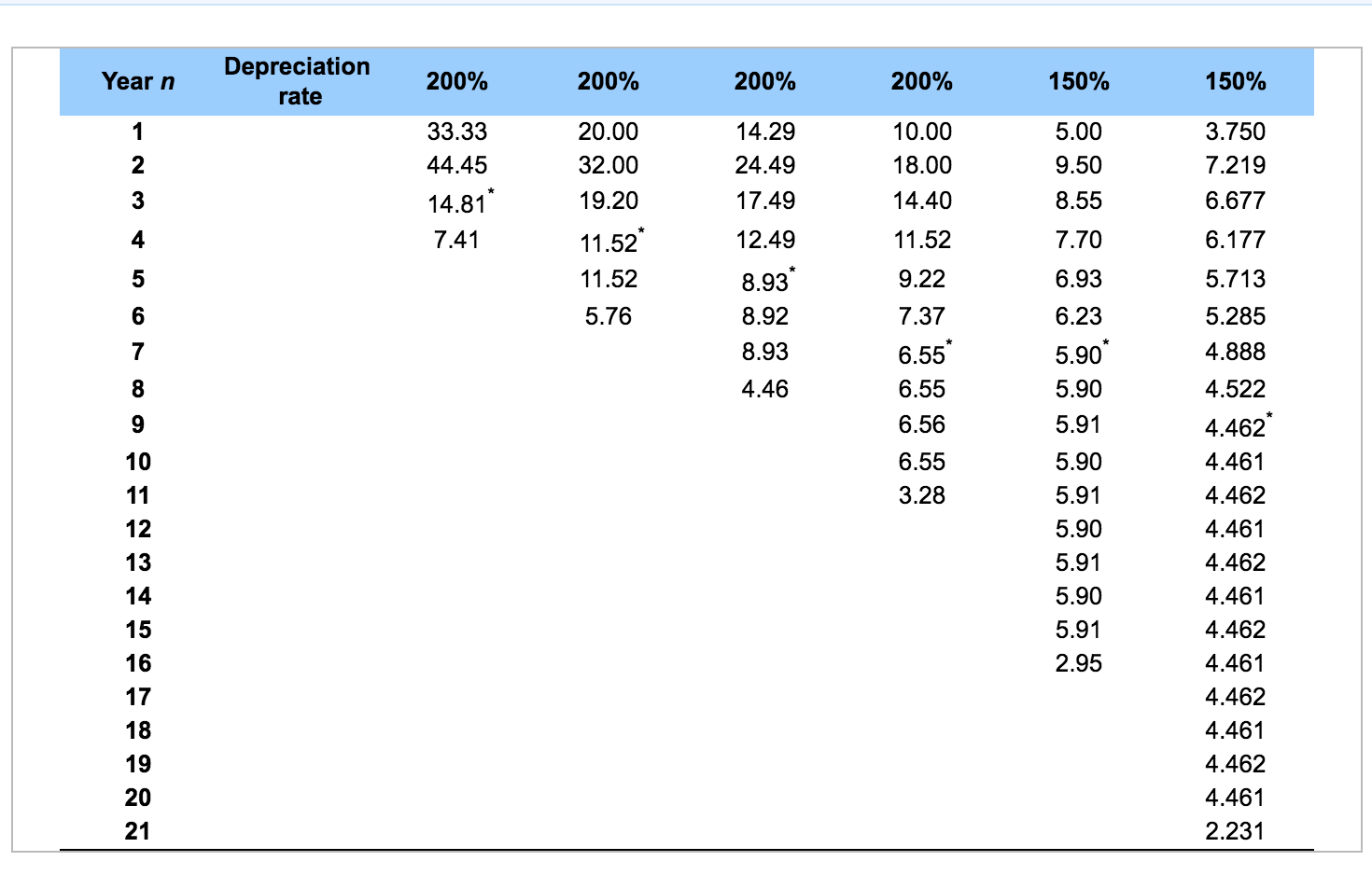

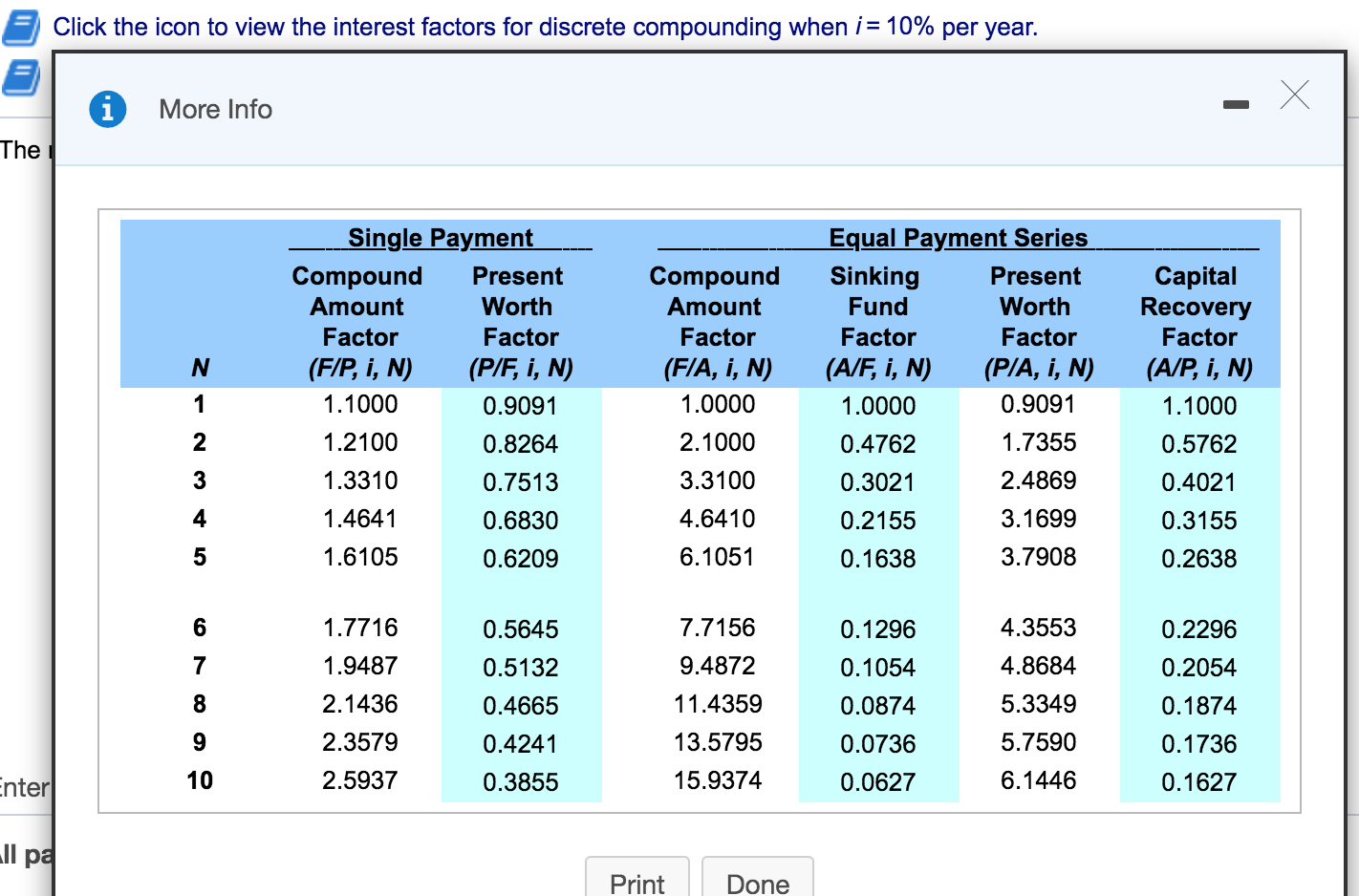

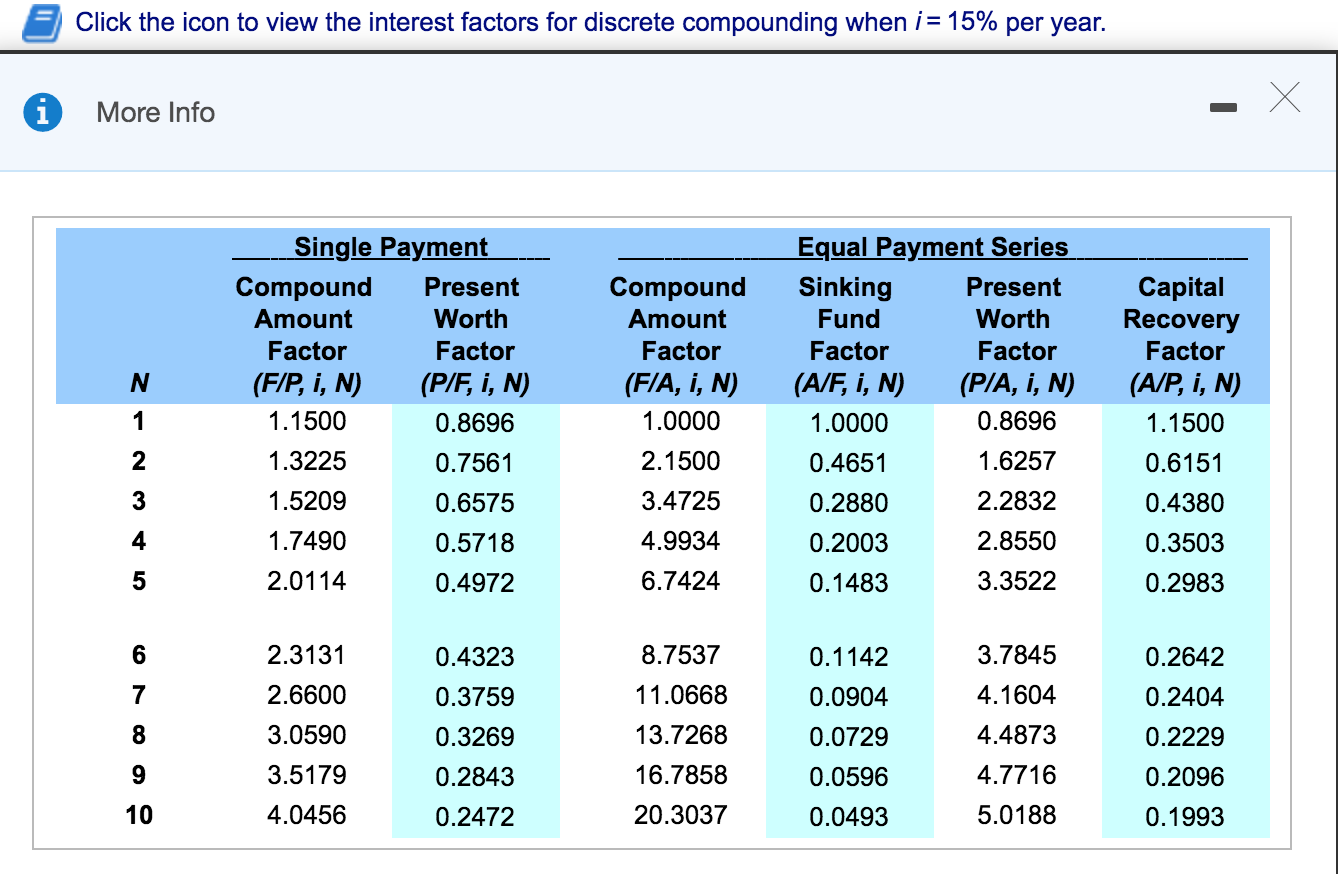

A special-purpose machine tool set would cost $20,000. The tool set will be financed by a $10,000 bank loan repayable in two equal annual installments at 10% compounded annually. The tool is expected to provide annual (material) savings of $30,000 for two years and is to be depreciated by the MACRS three-year recovery period. The tool will require annual O&M costs in the amount of $5,000. The salvage value at the end of the two years is expected to be $8,000. Assuming a marginal tax rate of 25% and MARR of 15%, what is the net present worth of this project? Click the icon to view the worksheet for your calculation. Click the icon to view the MACRS depreciation schedules. 5 Click the icon to view the interest factors for discrete compounding when i = 10% per year. Click the icon to view the interest factors for discrete compounding when i = 15% per year. The net present worth of the project is $1 thousand. (Round to one decimal place.) 0 1 2 $10,400 6,666 $12,019 4,445 Cash Flow Statement Operating activities Net income Depreciation Investment activities Investment Salvage Gains tax (40%) Financial activities Borrowed funds Principal repayment Net cash flow - $20,000 8,000 10,000 -$10,000 Year n Depreciation rate 200% 200% 200% 200% 150% 150% 33.33 44.45 14.81" 7.41 14.29 24.49 17.49 10.00 18.00 14.40 3.750 7.219 6.677 20.00 32.00 19.20 11.52* 11.52 5.76 11.52 6.177 12.49 8.93* 8.92 8.93 5.00 9.50 8.55 7.70 6.93 6.23 5.90* 5.90 5.91 9.22 7.37 6.55* 6.55 6.56 6.55 3.28 4.46 10 13 5.90 5.91 5.90 5.91 5.90 5.91 2.95 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 14 15 16 17 18 19 20 21 2 Click the icon to view the interest factors for discrete compounding when i = 10% per year. More Info The Single Payment Compound Present Amount Worth Factor Factor (FIP, i, N (P/F, i, N 1.1000 0.9091 1.2100 0.8264 1.3310 0.7513 1.4641 0.6830 1.6105 0.6209 Compound Amount Factor (FIA, I, N 1.0000 2.1000 3.3100 4.6410 6.1051 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, I, N) 1.0000 0.9091 0.4762 1.7355 0.3021 2.4869 0.2155 3.1699 0.1638 3.7908 Capital Recovery Factor (A/P, i, N) 1.1000 0.5762 0.4021 0.3155 0.2638 1.7716 1.9487 2.1436 2.3579 2.5937 0.5645 0.5132 0.4665 0.4241 0.3855 7.7156 9.4872 11.4359 13.5795 15.9374 0.1296 0.1054 0.0874 0.0736 0.0627 4.3553 4.8684 5.3349 5.7590 0.2296 0.2054 0.1874 0.1736 0.1627 Enter 6.1446 all pa Print Done Click the icon to view the interest factors for discrete compounding when i = 15% per year. More Info Single Payment Compound Present Amount Worth Factor Factor (F/P, i, N) (PIF, i, N) 1.1500 0.8696 1.3225 0.7561 1.5209 0.6575 1.7490 0.5718 2.0114 0.4972 Compound Amount Factor (F/A, I, N. 1.0000 2.1500 3.4725 4.9934 6.7424 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, I, N) 1.0000 0.8696 0.4651 1.6257 0.2880 2.2832 0.2003 2.8550 0.1483 3.3522 Capital Recovery Factor (A/P, i, N) 1.1500 0.6151 0.4380 0.3503 0.2983 2.3131 2.6600 3.0590 3.5179 4.0456 0.4323 0.3759 0.3269 0.2843 0.2472 8.7537 11.0668 13.7268 16.7858 20.3037 0.1142 0.0904 0.0729 0.0596 0.0493 3.7845 4.1604 4.4873 4.7716 5.0188 0.2642 0.2404 0.2229 0.2096 0.1993

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts