Question: A speculator expects a decrease in price of XYZ stock. He buys 5 put option contracts (one option contract is on 100 pieces of XYZ

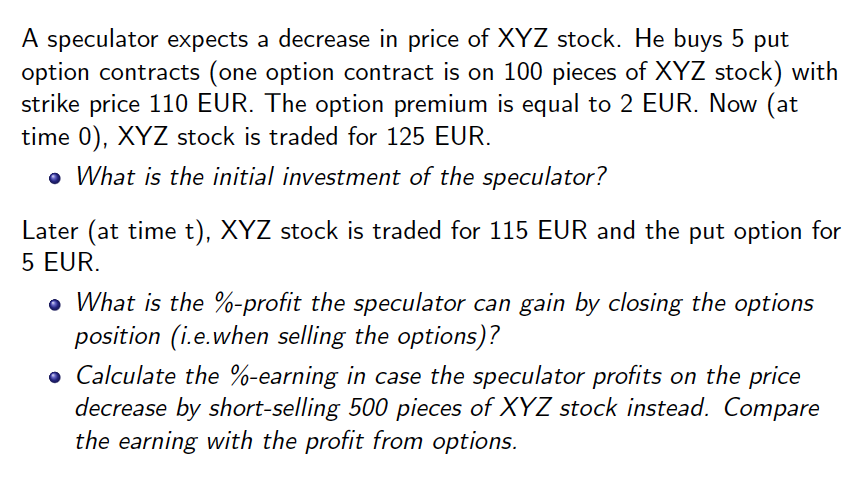

A speculator expects a decrease in price of XYZ stock. He buys 5 put option contracts (one option contract is on 100 pieces of XYZ stock) with strike price 110 EUR. The option premium is equal to 2 EUR. Now (at time 0), XYZ stock is traded for 125 EUR. What is the initial investment of the speculator? Later (at time t), XYZ stock is traded for 115 EUR and the put option for 5 EUR. What is the %-profit the speculator can gain by closing the options position (i.e.when selling the options)? Calculate the %-earning in case the speculator profits on the price decrease by short-selling 500 pieces of XYZ stock instead. Compare the earning with the profit from options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts