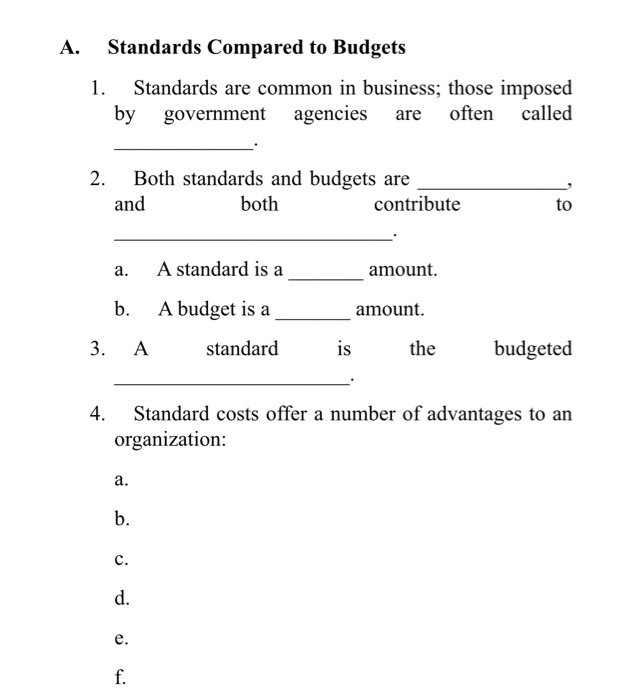

Question: A. Standards Compared to Budgets 1. Standards are common in business; those imposed by government agencies are often called 2. Both standards and budgets are

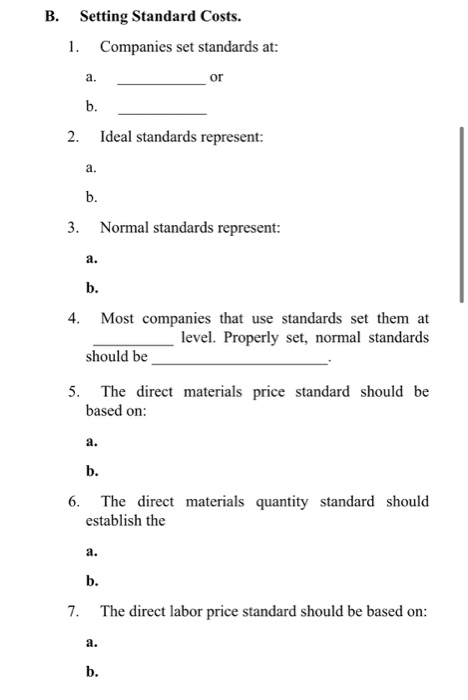

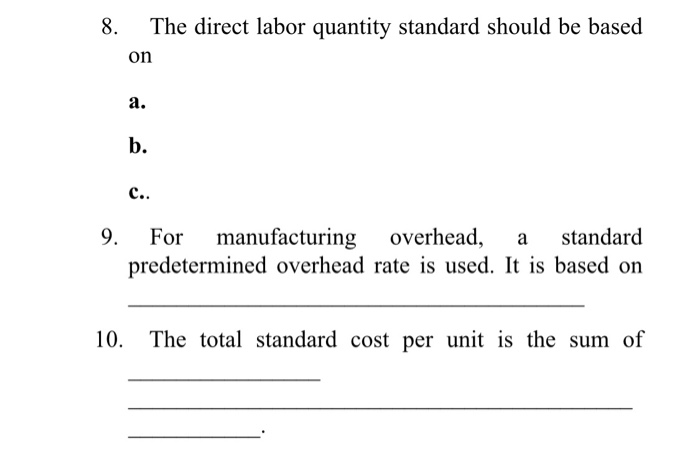

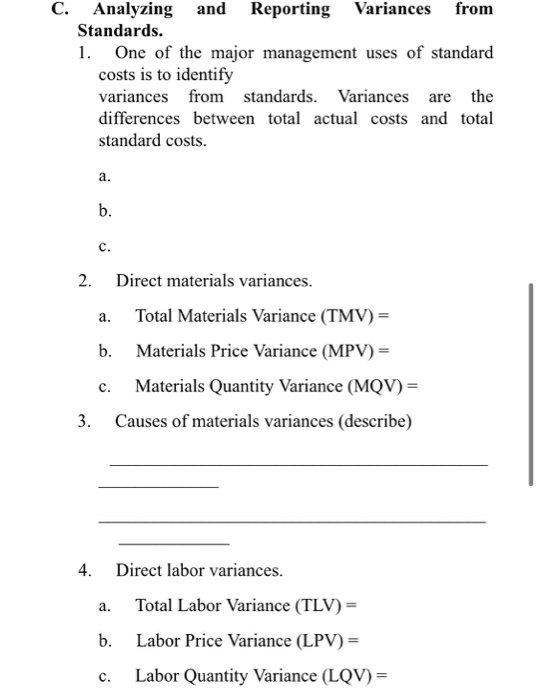

A. Standards Compared to Budgets 1. Standards are common in business; those imposed by government agencies are often called 2. Both standards and budgets are and both contribute to a. A standard is a amount. b. A budget is a amount. 3. A standard is the budgeted 4. Standard costs offer a number of advantages to an organization: a. b. c. d. e. f. B. Setting Standard Costs. 1. Companies set standards at: a. or b. 2. Ideal standards represent: a. b. 3. Normal standards represent: a. b. 4. Most companies that use standards set them at level. Properly set, normal standards should be 5. The direct materials price standard should be based on: a. b. 6. The direct materials quantity standard should establish the a. b. 7. The direct labor price standard should be based on: a. b. 8. The direct labor quantity standard should be based on a. b. c.. 9. For manufacturing overhead, a standard predetermined overhead rate is used. It is based on 10. The total standard cost per unit is the sum of C. Analyzing and Reporting Variances from Standards. 1. One of the major management uses of standard costs is to identify variances from standards. Variances are the differences between total actual costs and total standard costs. a. b. c. a. 2. Direct materials variances. Total Materials Variance (TMV) = b. Materials Price Variance (MPV) = Materials Quantity Variance (MQV) = 3. Causes of materials variances (describe) c. a. 4. Direct labor variances. Total Labor Variance (TLV) = b. Labor Price Variance (LPV)= Labor Quantity Variance (LQV)= c. 5. Causes of labor variances. a. b. 6. Manufacturing overhead variance. a. Total Overhead Variance. (Overhead applied is based on standard hours allowed) = 7. Causes of manufacturing overhead variance. a. b. D. Reporting Variances. 1. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts