Question: A. Start with the journal papers tab, record the May transactions that occurred they are listed below in B. Each transaction does require an entry.

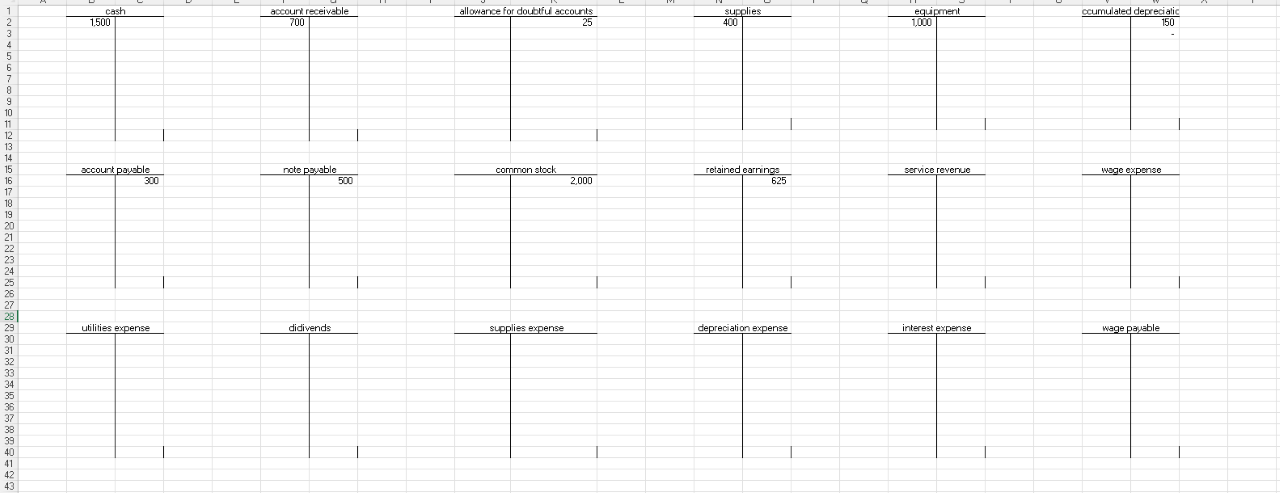

A. Start with the journal papers tab, record the May transactions that occurred they are listed below in B. Each transaction does require an entry. Refer to the pages of t-accounts for a list of the company's accounts. Some accounts will already have balances in them. Do not delete or erase them, those are permanent accounts left over from the previous accounting period.

B. The following transactions describe business activity for Tommy's Boat & Tackle during May of 2021:

May 1: The company generated $55,000 from the sale of its common stock.

May 4: $10,800 of equipment was purchased with a $900 cash down payment. The balance should be paid within the next 90 days.

May 6: Tommy, on behalf of the company, signed a 5-year note, borrowing $27,750 from the local bank.

May 7: Tommy's crew completed a fishing boat customization job for the Smiths; a bill for $22,000 was sent to the customer.

May 9: The company paid its workers May wages of $6,615.

May 11: Tommy's Boat & Tackle purchased $12,250 of supplies on account.

May 14: One of Tommy's employees completed $14,400 of repairs on fishing gear and received payment immediately.

May 16: The company paid half of the amount owed on the equipment purchased on May 4.

May 22: Tommy's Boat & Tackle paid cash dividends of $8,500 to its shareholders.

May 25: The Smiths paid Tommy's one-half of the amount described in the May 7 transaction.

May 29: A bill in the amount of $820 for the company's May electric service arrived but was not immediately paid. It was not paid until the following month.

May 31: One of Tommy's employees completed $7,500 of repairs on account.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts