Question: A start-up company is considering purchasing new software that would be better able to track consumer preferences for their products. The equipment will cost $15,500

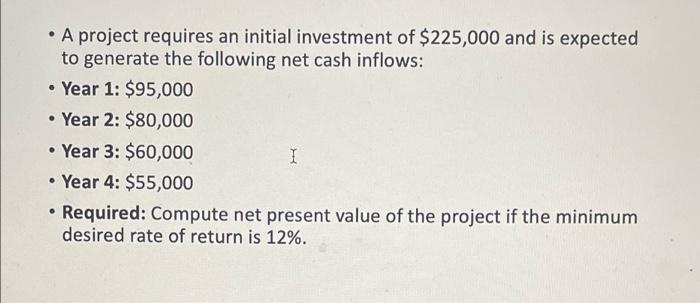

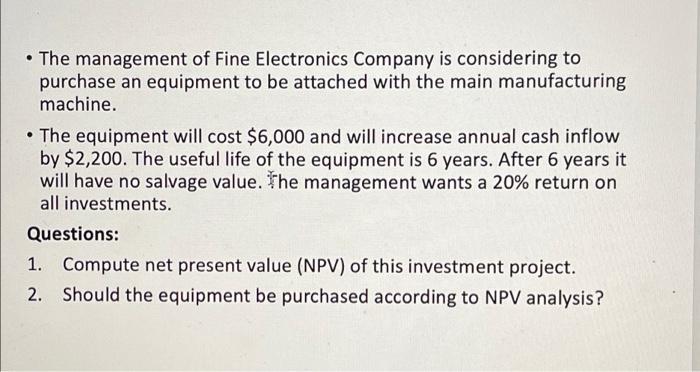

A project requires an initial investment of $225,000 and is expected to generate the following net cash inflows: Year 1: $95,000 Year 2: $80,000 Year 3: $60,000 1 Year 4: $55,000 Required: Compute net present value of the project if the minimum desired rate of return is 12%. The management of Fine Electronics Company is considering to purchase an equipment to be attached with the main manufacturing machine. The equipment will cost $6,000 and will increase annual cash inflow by $2,200. The useful life of the equipment is 6 years. After 6 years it will have no salvage value. The management wants a 20% return on all investments. Questions: 1. Compute net present value (NPV) of this investment project. 2. Should the equipment be purchased according to NPV analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts