Question: (a) State whether or not the Binomial Method and the Monte Carlo method are naturally suited to computing accurate approximations of the following options.

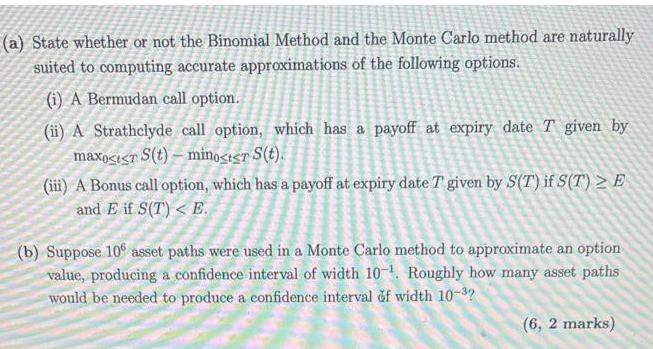

(a) State whether or not the Binomial Method and the Monte Carlo method are naturally suited to computing accurate approximations of the following options. (i) A Bermudan call option. (ii) A Strathclyde call option, which has a payoff at expiry date T given by maxostr S(t)- minoster S(t). (iii) A Bonus call option, which has a payoff at expiry date 7 given by S(T) if S(T) E and E if S(T) < E. (b) Suppose 106 asset paths were used in a Monte Carlo method to approximate an option value, producing a confidence interval of width 10-1. Roughly how many asset paths would be needed to produce a confidence interval of width 10-3? (6,2 marks) (a) State whether or not the Binomial Method and the Monte Carlo method are naturally suited to computing accurate approximations of the following options. (i) A Bermudan call option. (ii) A Strathclyde call option, which has a payoff at expiry date T given by maxostr S(t)- minoster S(t). (iii) A Bonus call option, which has a payoff at expiry date 7 given by S(T) if S(T) E and E if S(T) < E. (b) Suppose 106 asset paths were used in a Monte Carlo method to approximate an option value, producing a confidence interval of width 10-1. Roughly how many asset paths would be needed to produce a confidence interval of width 10-3? (6,2 marks)

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step 12 ai No the Binomial Method and the Monte Carlo method are not naturally suited t... View full answer

Get step-by-step solutions from verified subject matter experts