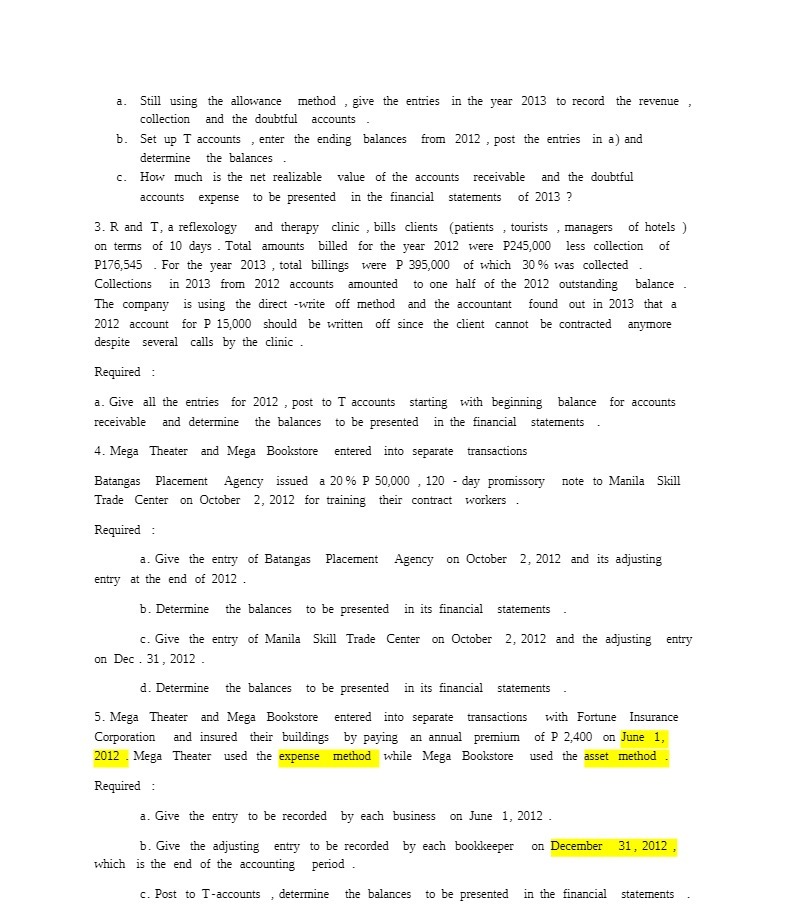

Question: a. Still using the allowance method , give the entries in the year 2013 to record the revenue collection and the doubtful accounts b .

a. Still using the allowance method , give the entries in the year 2013 to record the revenue collection and the doubtful accounts b . Set up T accounts , enter the ending balances from 2012 , post the entries in a ) and determine the balances C. How much is the net realizable value of the accounts receivable and the doubtful accounts expense to be presented in the financial statements of 2013 ? 3. R and T, a reflexology and therapy clinic , bills clients (patients , tourists , managers of hotels ) on terms of 10 days . Total amounts billed for the year 2012 were P245,000 less collection of P176,545 . For the year 2013 , total billings were P 395,000 of which 30 % was collected Collections in 2013 from 2012 accounts amounted to one half of the 2012 outstanding balance The company is using the direct -write off method and the accountant found out in 2013 that a 2012 account for P 15,000 should be written off since the client cannot be contracted anymore despite several calls by the clinic Required : a. Give all the entries for 2012 , post to T accounts starting with beginning balance for accounts receivable and determine the balances to be presented in the financial statements 4. Mega Theater and Mega Bookstore entered into separate transactions Batangas Placement Agency issued a 20 % P 50,000 , 120 - day promissory note to Manila Skill Trade Center on October 2, 2012 for training their contract workers Required : a. Give the entry of Batangas Placement Agency on October 2, 2012 and its adjusting entry at the end of 2012 . b. Determine the balances to be presented in its financial statements c. Give the entry of Manila Skill Trade Center on October 2, 2012 and the adjusting entry on Dec . 31 , 2012 . d. Determine the balances to be presented in its financial statements 5. Mega Theater and Mega Bookstore entered into separate transactions with Fortune Insurance Corporation and insured their buildings by paying an annual premium of P 2,400 on June 1, 2012 . Mega Theater used the expense method while Mega Bookstore used the asset method Required : a. Give the entry to be recorded by each business on June 1, 2012 . b. Give the adjusting entry to be recorded by each bookkeeper on December 31, 2012 , which is the end of the accounting period c. Post to T-accounts , determine the balances to be presented in the financial statements