Question: A stock currently trades at ( $ 1 0 0 ) , with a volatility of ( 2 5 %

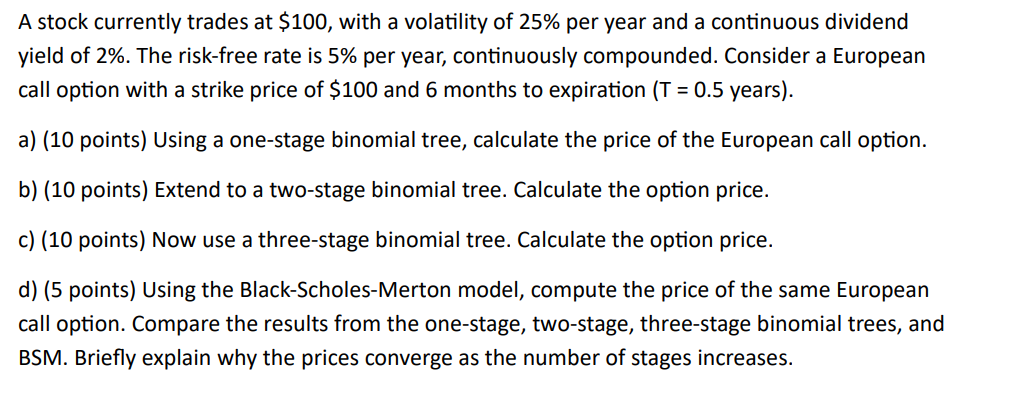

A stock currently trades at $ with a volatility of per year and a continuous dividend yield of The riskfree rate is per year, continuously compounded. Consider a European call option with a strike price of $ and months to expiration T years a points Using a onestage binomial tree, calculate the price of the European call option. b points Extend to a twostage binomial tree. Calculate the option price. c points Now use a threestage binomial tree. Calculate the option price. d points Using the BlackScholesMerton model, compute the price of the same European call option. Compare the results from the onestage, twostage, threestage binomial trees, and BSM Briefly explain why the prices converge as the number of stages increases.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock