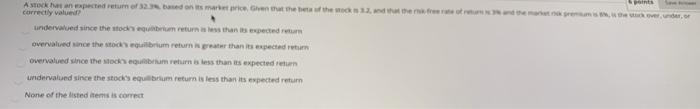

Question: a stock has a expected return if 32.3 given that the beta of the stock is 3.2 and that rhe risk free rate of teturn

Akanpected return 32. marchenthate the where correctly valued undervalued since the storm return is less than is expected retum overvalued since the souborum return great than its spected return overvalued since the souveniless than is expected return undervalued since the stock's equum return is less than its expected retum None of the listed items is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts