Question: A stock has volatility = 35% and initial price so = $15. The risk-free rate is r = 3. [5] Find the BSM price

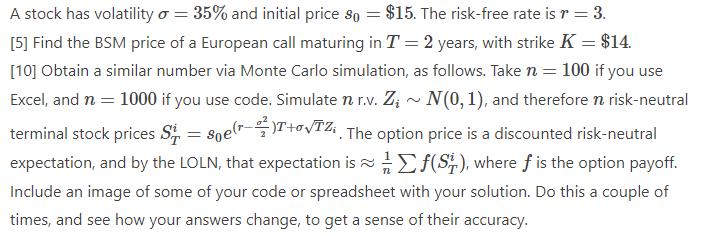

A stock has volatility = 35% and initial price so = $15. The risk-free rate is r = 3. [5] Find the BSM price of a European call maturing in T = 2 years, with strike K = $14. [10] Obtain a similar number via Monte Carlo simulation, as follows. Take n = 100 if you use Excel, and n = 1000 if you use code. Simulate n r.v. Z;~ N(0, 1), and therefore n risk-neutral terminal stock prices S = Soe(r)T+TZ. The option price is a discounted risk-neutral expectation, and by the LOLN, that expectation is f(S), where f is the option payoff. Include an image of some of your code or spreadsheet with your solution. Do this a couple of times, and see how your answers change, to get a sense of their accuracy.

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

SOLUTION Using the BlackScholesMerton BSM model the price of a European call option with strike K 14 ... View full answer

Get step-by-step solutions from verified subject matter experts