Question: A stock is expected to pay $2 per share every year indefinitely. The current price of the stock is $40. The equity cost of capital

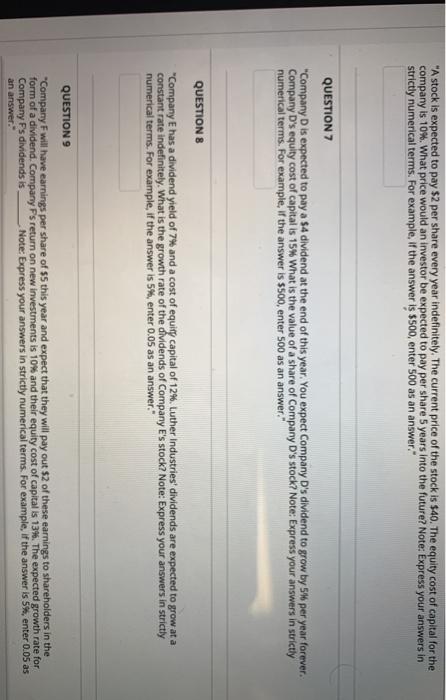

"A stock is expected to pay $2 per share every year indefinitely. The current price of the stock is $40. The equity cost of capital for the company is 10%. What price would an investor be expected to pay per share 5 years into the future? Note: Express your answers in strictly numerical terms. For example, if the answer is $500, enter 500 as an answer." QUESTION 7 "Company D is expected to pay a $4 dividend at the end of this year. You expect Company D's dividend to grow by 5% per year forever. Company D's equity cost of capital is 15% What is the value of a share of Company D's stock? Note: Express your answers in strictly numerical terms. For example, if the answer is $500, enter 500 as an answer." QUESTIONS "Company E has a dividend yield of 7% and a cost of equity capital of 12%. Luther Industries' dividends are expected to grow at a constant rate indefinitely. What is the growth rate of the dividends of Company E's stock? Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, enter 0.05 as an answer." QUESTION 9 "Company F will have earnings per share of $5 this year and expect that they will pay out $2 of these earnings to shareholders in the form of a dividend. Company Fs return on new investments is 10% and their equity cost of capital is 13%. The expected growth rate for Company Fs dividends is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, enter 0.05 as an answer." "A stock is expected to pay $2 per share every year indefinitely. The current price of the stock is $40. The equity cost of capital for the company is 10%. What price would an investor be expected to pay per share 5 years into the future? Note: Express your answers in strictly numerical terms. For example, if the answer is $500, enter 500 as an answer." QUESTION 7 "Company D is expected to pay a $4 dividend at the end of this year. You expect Company D's dividend to grow by 5% per year forever. Company D's equity cost of capital is 15% What is the value of a share of Company D's stock? Note: Express your answers in strictly numerical terms. For example, if the answer is $500, enter 500 as an answer." QUESTIONS "Company E has a dividend yield of 7% and a cost of equity capital of 12%. Luther Industries' dividends are expected to grow at a constant rate indefinitely. What is the growth rate of the dividends of Company E's stock? Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, enter 0.05 as an answer." QUESTION 9 "Company F will have earnings per share of $5 this year and expect that they will pay out $2 of these earnings to shareholders in the form of a dividend. Company Fs return on new investments is 10% and their equity cost of capital is 13%. The expected growth rate for Company Fs dividends is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, enter 0.05 as an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts