Question: A stock is expected to pay its first $2.9 dividend in 4 years from now (t=4). The dividend is expected to be paid annually forever

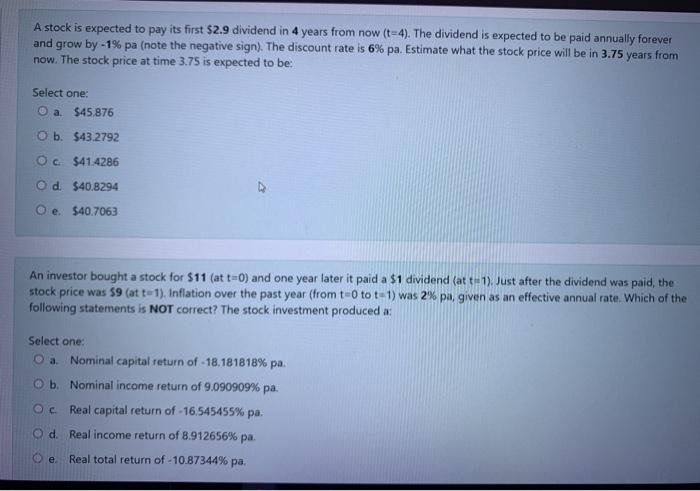

A stock is expected to pay its first $2.9 dividend in 4 years from now (t=4). The dividend is expected to be paid annually forever and grow by -1% pa (note the negative sign). The discount rate is 6% pa. Estimate what the stock price will be in 3.75 years from now. The stock price at time 3.75 is expected to be Select one: O a $45.876 O b. $43.2792 Oc$41.4286 Od $40.8294 Oe. $40.7063 An investor bought a stock for $11 (at t=0) and one year later it paid a $1 dividend (at t=1). Just after the dividend was paid, the stock price was 59 (att-1). Inflation over the past year (from 0 tot 1) was 2% pa, given as an effective annual rate. Which of the following statements is NOT correct? The stock investment produced a Select one: O a. Nominal capital return of -18.181818% pa. O b. Nominal income return of 9.090909% pa. Oc Real capital return of -16.545455% pa. O d. Real income return of 8.912656% pa. e. Real total return of -10.87344% pa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts