Question: A stock is expected to pay its first $46 dividend in 2 years from now. The dividend is expected to be paid annually forever and

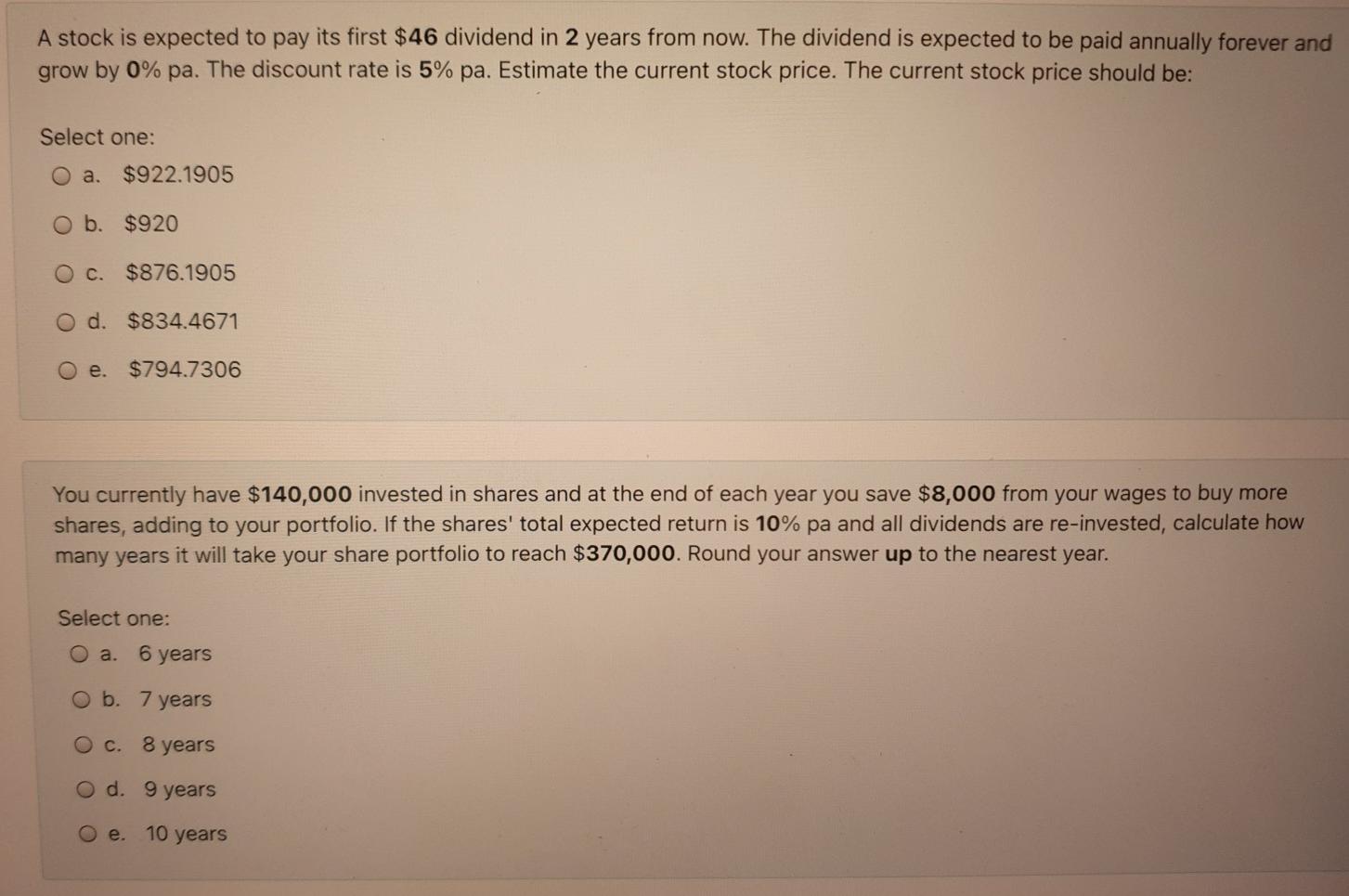

A stock is expected to pay its first $46 dividend in 2 years from now. The dividend is expected to be paid annually forever and grow by 0% pa. The discount rate is 5% pa. Estimate the current stock price. The current stock price should be: Select one: O a. $922.1905 O b. $920 O c. $876.1905 O d. $834.4671 O e. $794.7306 You currently have $140,000 invested in shares and at the end of each year you save $8,000 from your wages to buy more shares, adding to your portfolio. If the shares' total expected return is 10% pa and all dividends are re-invested, calculate how many years it will take your share portfolio to reach $370,000. Round your answer up to the nearest year. Select one: O a. 6 years O b. 7 years O C. 8 years O d. 9 years O e. 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts