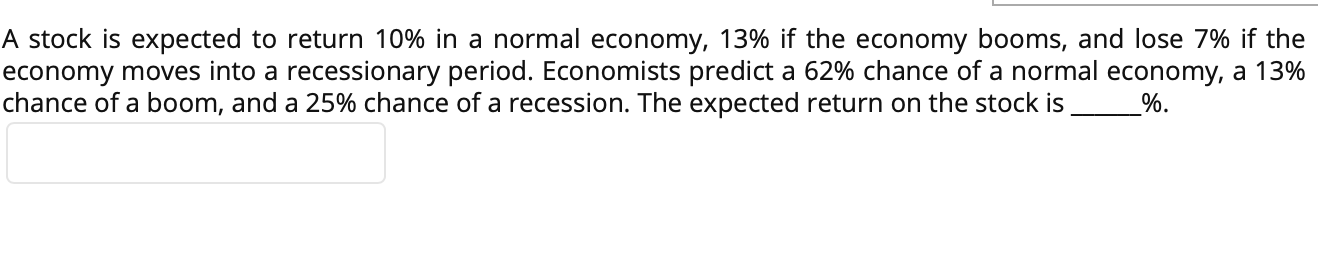

Question: A stock is expected to return 10% in a normal economy, 13% if the economy booms, and lose 7% if the economy moves into a

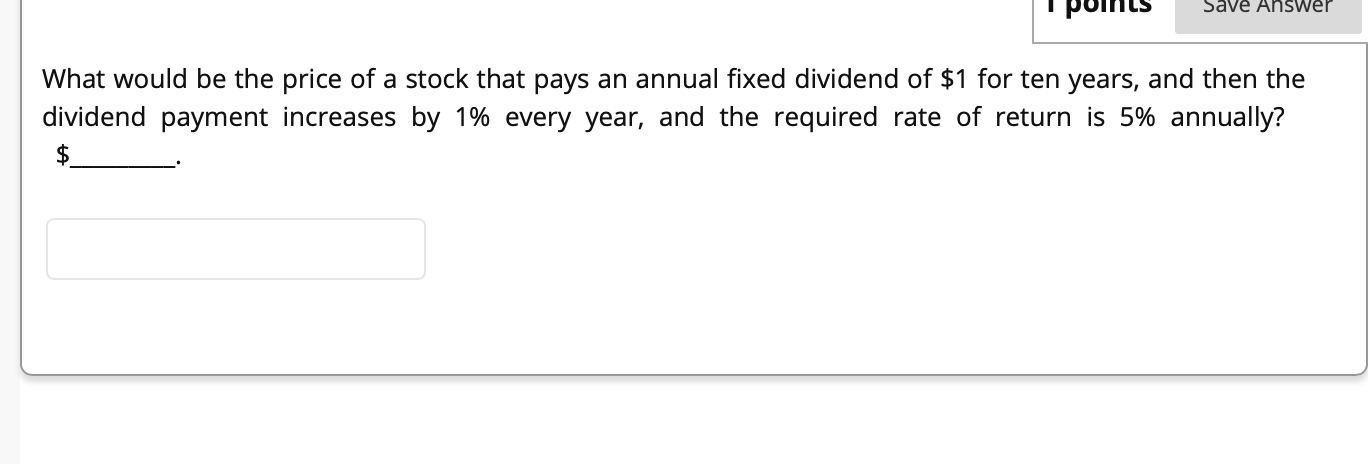

A stock is expected to return 10% in a normal economy, 13% if the economy booms, and lose 7% if the economy moves into a recessionary period. Economists predict a 62% chance of a normal economy, a 13% chance of a boom, and a 25% chance of a recession. The expected return on the stock is %. Save Answer What would be the price of a stock that pays an annual fixed dividend of $1 for ten years, and then the dividend payment increases by 1% every year, and the required rate of return is 5% annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts