Question: A stock that currently does not pay a dividend is expected to pay its first dividend of $1.00 five years from today. Thereafter, the dividend

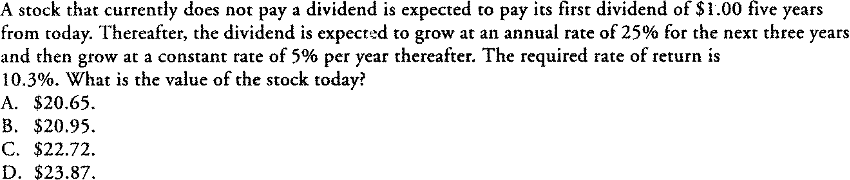

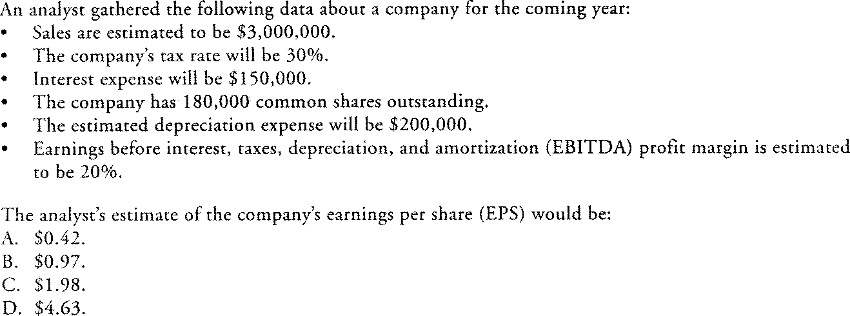

A stock that currently does not pay a dividend is expected to pay its first dividend of $1.00 five years from today. Thereafter, the dividend is expected to grow at an annual rate of 25% for the next three years and then grow at a constant rate of 5% per year thereafter. The required rate of return is 10.3%. What is the value of the stock today? A. $20.65. B. $20.95. C. $22.72. D. $23.87 An analyst gathered the following data about a company for the coming year: - Sales are escimated to be $3,000,000. - The company's tax rate will be 30%. - Interest expense will be $150,000. - The company has 180,000 common shares outstanding. - The estimated depreciation expense will be $200,000. - Earnings before interest, taxes, depreciation, and amortization (EBITDA) profit margin is estimatec to be 20%. The analyst's estimate of the company's earnings per share (EPS) would be: A. $0.42. B. $0.97. C. $1.98. D. $4.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts