Question: A stock will pay no dividends for the next 5 years. Six years from now, the stock is expected to pay its first dividend in

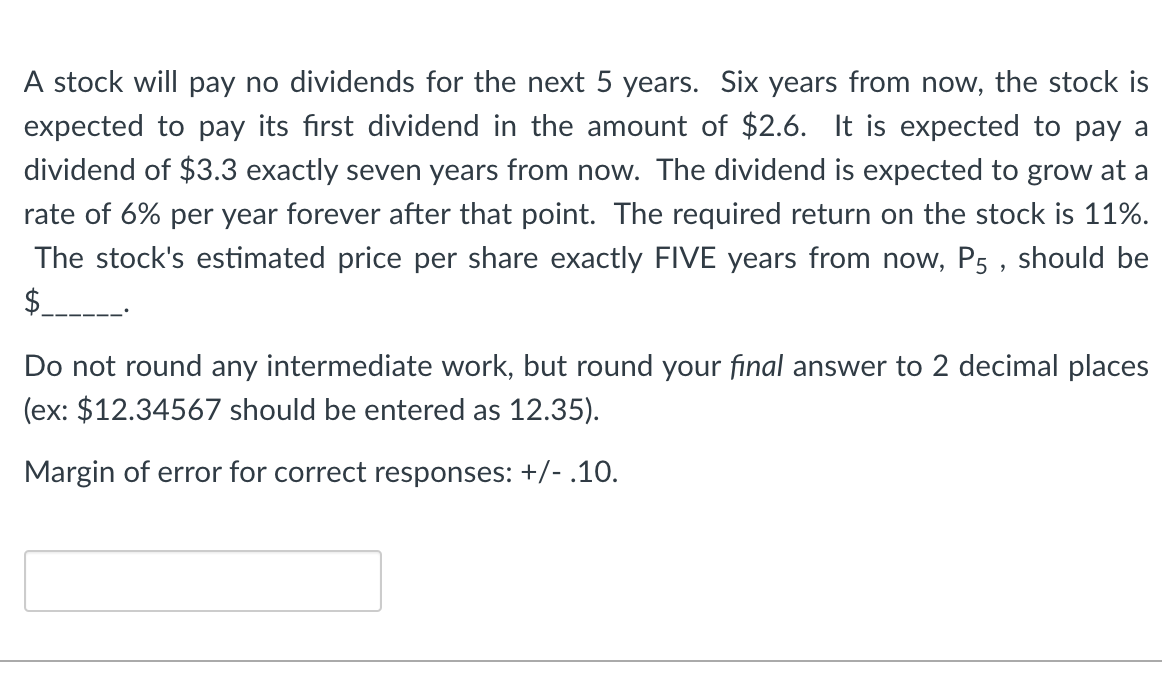

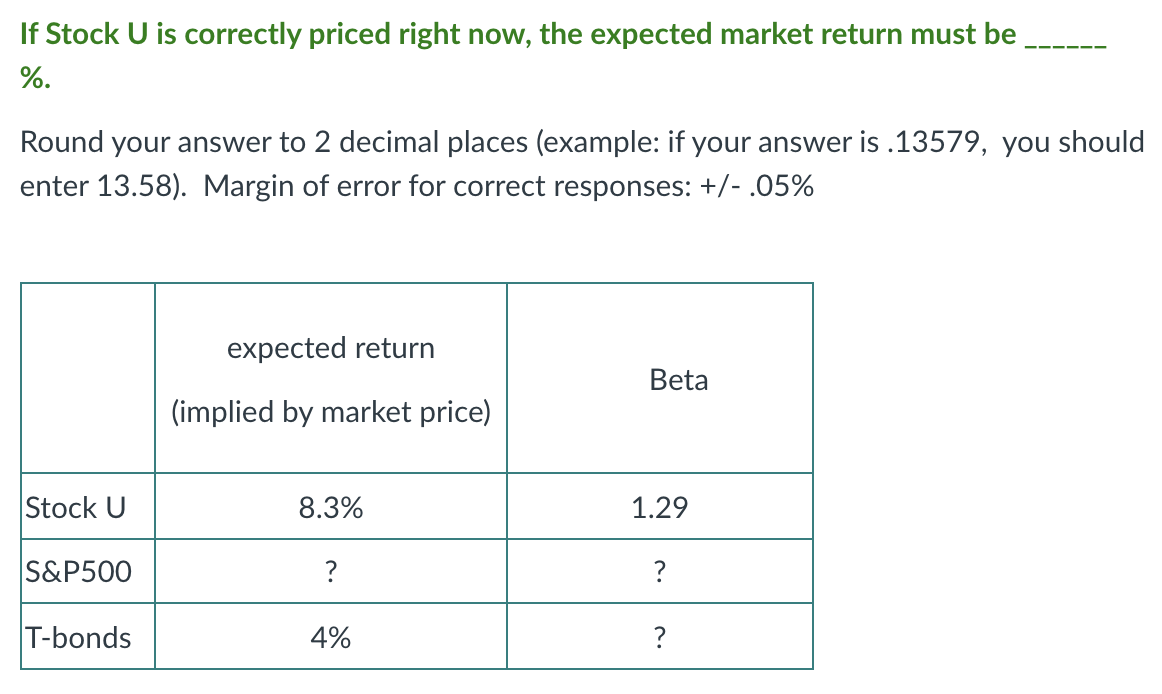

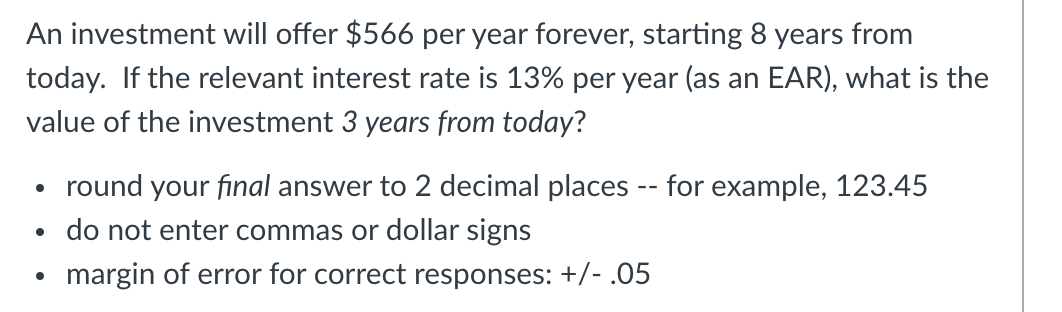

A stock will pay no dividends for the next 5 years. Six years from now, the stock is expected to pay its first dividend in the amount of $2.6. It is expected to pay a dividend of $3.3 exactly seven years from now. The dividend is expected to grow at a rate of 6% per year forever after that point. The required return on the stock is 11%. The stock's estimated price per share exactly FIVE years from now, P5 , should be $____ Do not round any intermediate work, but round your final answer to 2 decimal places (ex: $12.34567 should be entered as 12.35). Margin of error for correct responses: +/- .10. If Stock U is correctly priced right now, the expected market return must be %. Round your answer to 2 decimal places (example: if your answer is .13579, you should enter 13.58). Margin of error for correct responses: +/-.05% expected return Beta (implied by market price) Stock U 8.3% 1.29 S&P500 ? ? T-bonds 4% ? An investment will offer $566 per year forever, starting 8 years from today. If the relevant interest rate is 13% per year (as an EAR), what is the value of the investment 3 years from today? round your final answer to 2 decimal places -- for example, 123.45 do not enter commas or dollar signs margin of error for correct responses: +/- .05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts