Question: A stock with a beta of zero would be expected to a. have a rate of return. equal to one b. have a rate of

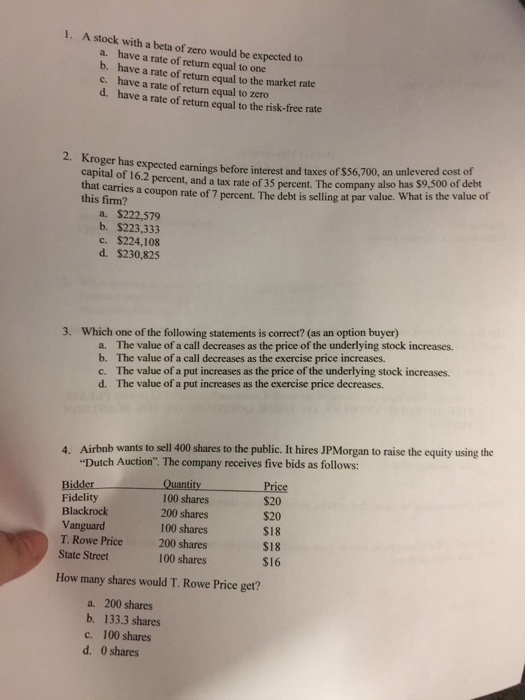

A stock with a beta of zero would be expected to a. have a rate of return. equal to one b. have a rate of return equal to the market rate c. have a rate of return equal to zero d. have a rate of return equal to the risk-free rate 2. Kroger has expected earnings before interest and taxes of $56, 700, an unlevered cost of capital of 16.2 that carries percent, and a tax rate of35 percent. The company also has $9, 500 of debt that carries a coupon rate of 7 percent. The debt is selling at par value. What is the value of this firm? a. $222, 579 b. $223, 333 c. $224, 108 d. $230, 825 Which one of the following statements is correct? (as an option buyer) a. The value of a call decreases as the price of the underlying stock increases. b. The value of a call decreases as the exercise price increases. c. The value of a put increases as the price of the underlying stock increases. d. The value of a put increases as the exercise price decreases. Airbnb wants to sell 400 shares to the public. It hires JPMorgan to raise the equity using the "Dutch Auction". The company receives five bids as follows: How many shares would T. Rowe Price get? a. 200 shares b. 133.3 shares c. 100 shares d. 0 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts