Question: A stock you are evaluating is expected to experience supernormal growth in dividends of 10 percent, gs , over the next five years. Following this

A stock you are evaluating is expected to experience supernormal growth in dividends of 10 percent, gs , over the next five years. Following this period, dividends are expected to grow at a constant rate of 4 percent, g. The stock paid a dividend of $4 last year, and the required rate of return on the stock is 15 percent.

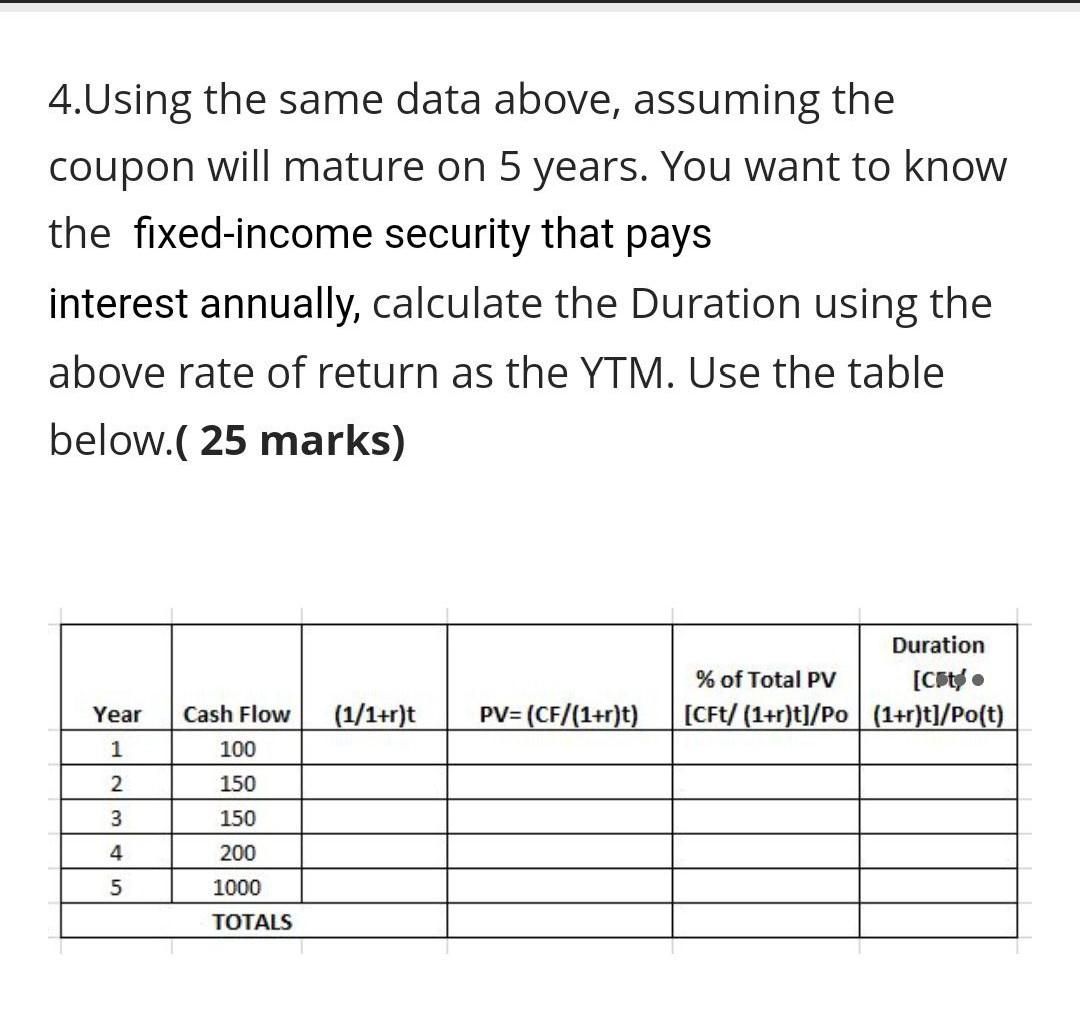

4.Using the same data above, assuming the coupon will mature on 5 years. You want to know the fixed-income security that pays interest annually, calculate the Duration using the above rate of return as the YTM. Use the table below.( 25 marks) Duration % of Total PV [C [CFt/ (1+r)t]/Po(1+r)t]/Po(t) Year Cash Flow 100 (1/1+r)t PV= (CF/(1+r)t) 1 2 150 3 150 4 200 5 1000 TOTALS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts