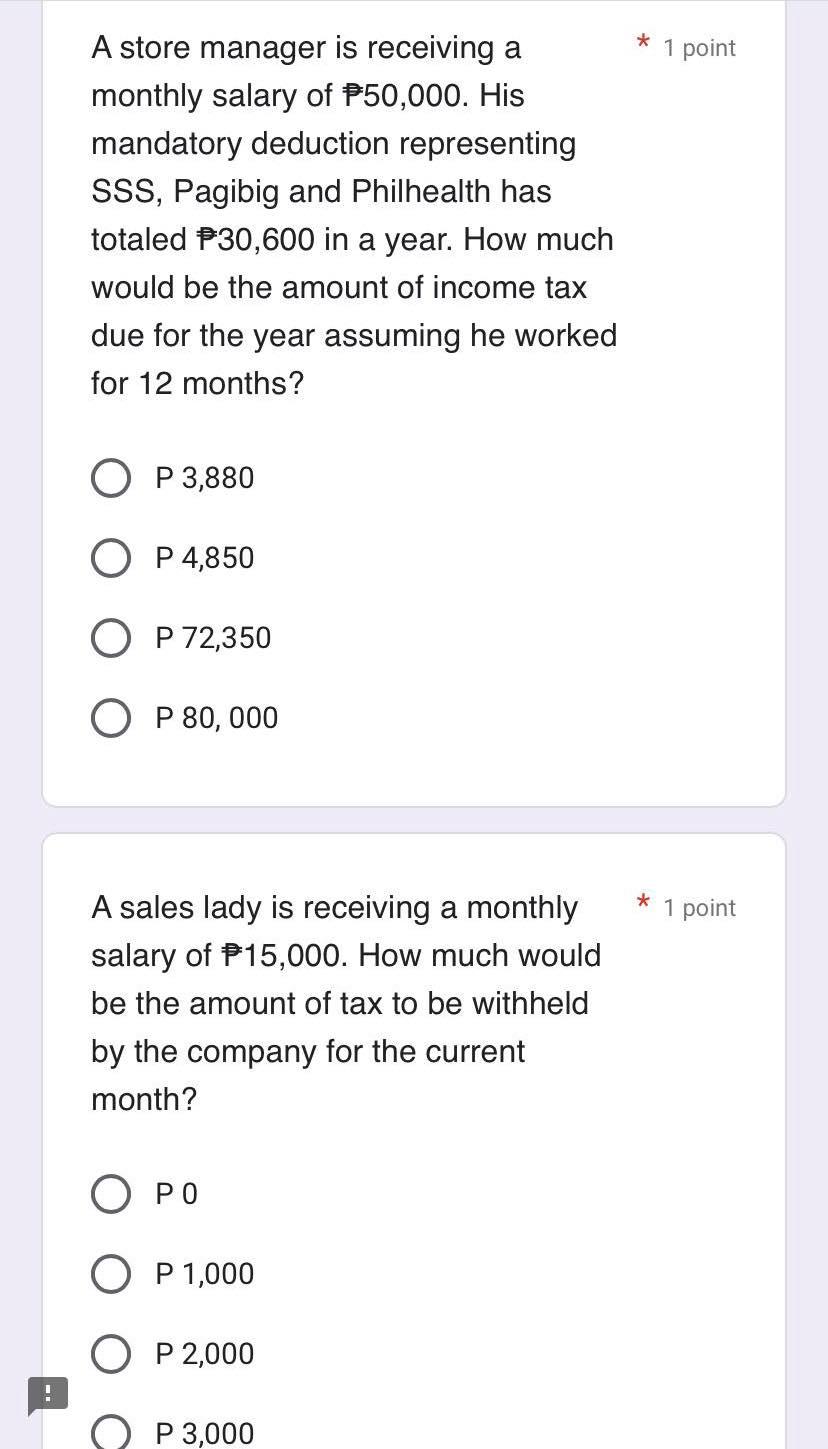

Question: A store manager is receiving a * 1 point monthly salary of 50,000. His mandatory deduction representing SSS, Pagibig and Philhealth has totaled F30,600 in

A store manager is receiving a * 1 point monthly salary of 50,000. His mandatory deduction representing SSS, Pagibig and Philhealth has totaled F30,600 in a year. How much would be the amount of income tax due for the year assuming he worked for 12 months? P3,880P4,850P72,350P80,000 A sales lady is receiving a monthly * 1 point salary of P15,000. How much would be the amount of tax to be withheld by the company for the current month? P 0 P 1,000 P2,000 P 3,000 A store manager is receiving a * 1 point monthly salary of 50,000. His mandatory deduction representing SSS, Pagibig and Philhealth has totaled F30,600 in a year. How much would be the amount of income tax due for the year assuming he worked for 12 months? P3,880P4,850P72,350P80,000 A sales lady is receiving a monthly * 1 point salary of P15,000. How much would be the amount of tax to be withheld by the company for the current month? P 0 P 1,000 P2,000 P 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts