Question: A store will cost $1,000,000 to open. Variable costs will be 55% of sales and fixed costs are $160,000 per year. The investment costs will

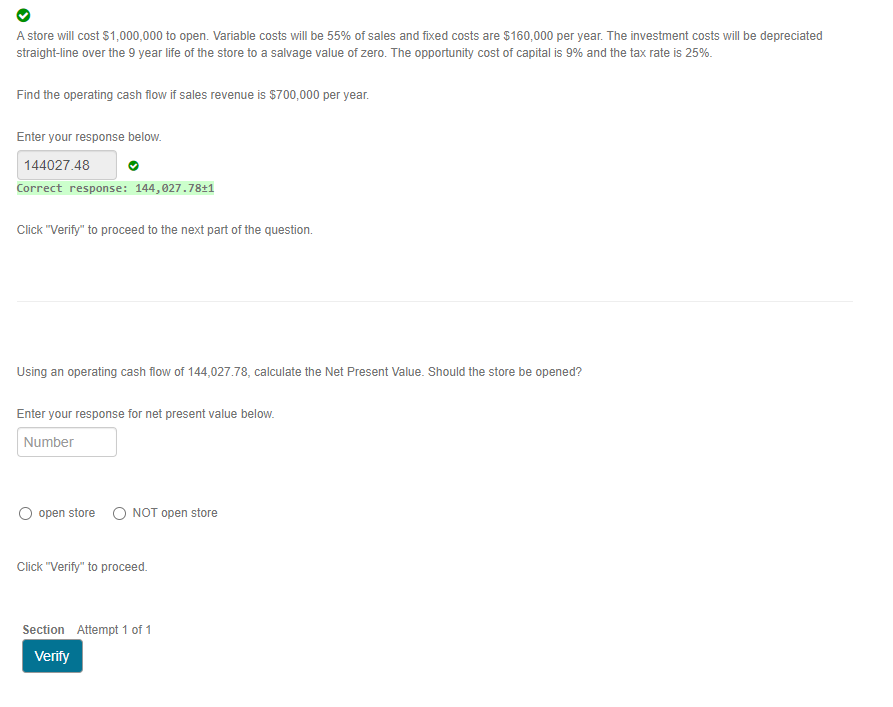

A store will cost $1,000,000 to open. Variable costs will be 55% of sales and fixed costs are $160,000 per year. The investment costs will be depreciated straight-line over the 9 year life of the store to a salvage value of zero. The opportunity cost of capital is 9% and the tax rate is 25%. Find the operating cash flow if sales revenue is $700,000 per year. Enter your response below. 144027.48 Correct response: 144,027.78+1 Click "Verify" to proceed to the next part of the question. Using an operating cash flow of 144,027.78, calculate the Net Present Value. Should the store be opened? Enter your response for net present value below. Number open store O NOT open store Click "Verify" to proceed. Section Attempt 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts