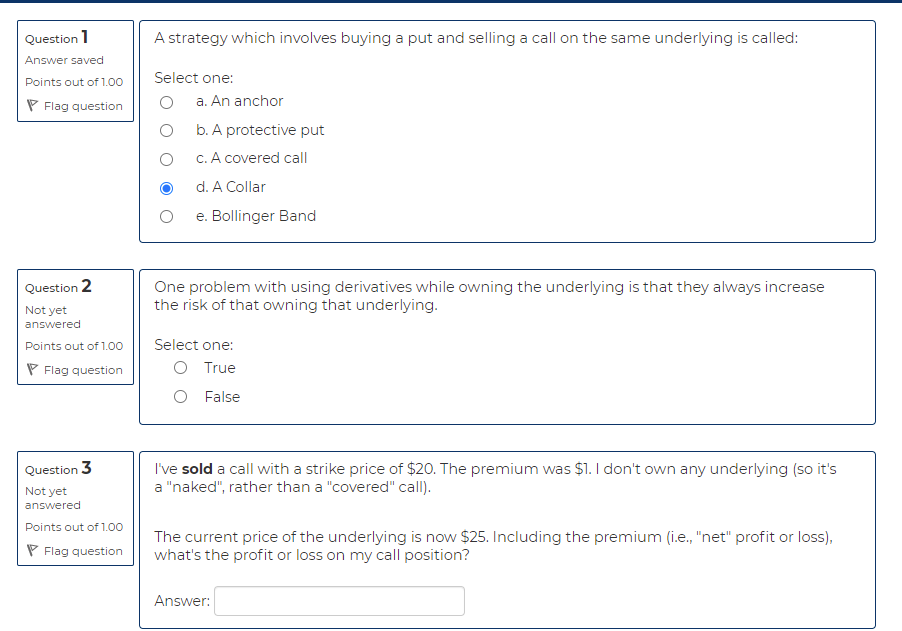

Question: A strategy which involves buying a put and selling a call on the same underlying is called: Question 1 Answer saved Points out of 1.00

A strategy which involves buying a put and selling a call on the same underlying is called: Question 1 Answer saved Points out of 1.00 Flag question Select one: O a. An anchor O b. A protective put O c. A covered call d. A Collar O e. Bollinger Band One problem with using derivatives while owning the underlying is that they always increase the risk of that owning that underlying. Question 2 Not yet answered Points out of 1.00 P Flag question Select one: O True O False I've sold a call with a strike price of $20. The premium was $1. I don't own any underlying (so it's a "naked", rather than a "covered" call). Question 3 Not yet answered Points out of 1.00 Flag question The current price of the underlying is now $25. Including the premium (i.e., "net" profit or loss), what's the profit or loss on my call position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts