Question: A. Strods, opened a business called Strods Engineering and recorded the following transactions in its first month of operations. June 1 A. Strods, the owner,

A. Strods, opened a business called Strods Engineering and recorded the following transactions in its first month of operations.

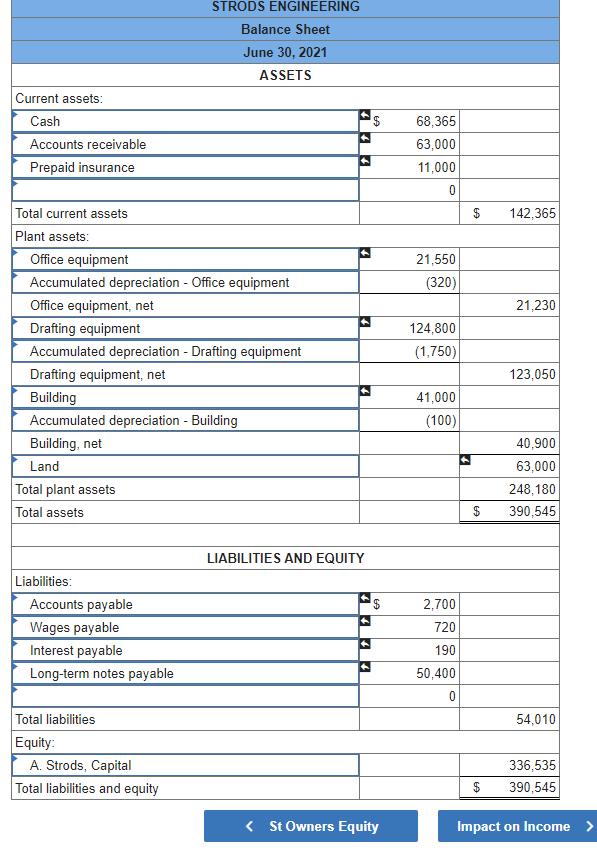

| June 1 | A. Strods, the owner, invested $156,000 cash, office equipment with a value of $19,000, and $88,000 of drafting equipment to launch the company. |

|---|---|

| June 2 | The company purchased land worth $63,000 for an office by paying $25,900 cash and signing a note payable for $37,100. |

| June 2 | The company purchased a portable building with $41,000 cash and moved it onto the land acquired on June 2. |

| June 2 | The company paid $11,400 cash for the premium on a 15-month insurance policy. |

| June 7 | The company completed and delivered a set of plans for a client and collected $17,400 cash. |

| June 12 | The company purchased $36,800 of additional drafting equipment by paying $23,500 cash and signing a payable for $13,300. |

| June 14 | The company completed $36,400 of engineering services for a client. This amount is to be received in 30 days. |

| June 15 | The company purchased $2,550 of additional office equipment on credit. |

| June 17 | The company completed engineering services for $27,600 on credit. |

| June 18 | The company received a bill for rent of equipment that was used on a recently completed job. The $2,700 rent cost must be paid within 30 days. |

| June 20 | The company collected $18,200 cash in partial payment from the client billed on June 14. |

| June 21 | The company paid $1,800 cash for wages to a drafting assistant. |

| June 23 | The company paid $2,550 cash to settle the account payable created on June 15. |

| June 24 | The company paid $1,625 cash for repairs. |

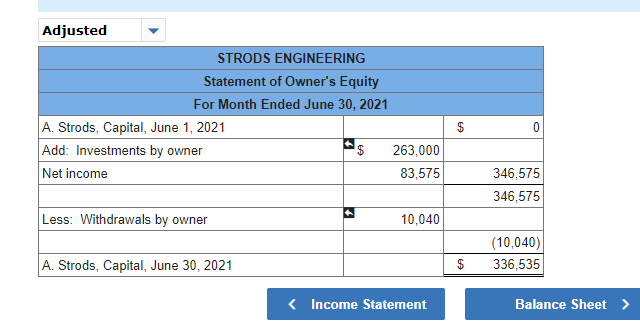

| June 26 | A. Strods withdrew $10,040 cash from the company for personal use. |

| June 28 | The company paid $1,800 cash for wages to a drafting assistant. |

| June 30 | The company paid $3,620 cash for advertisements on the web during June. |

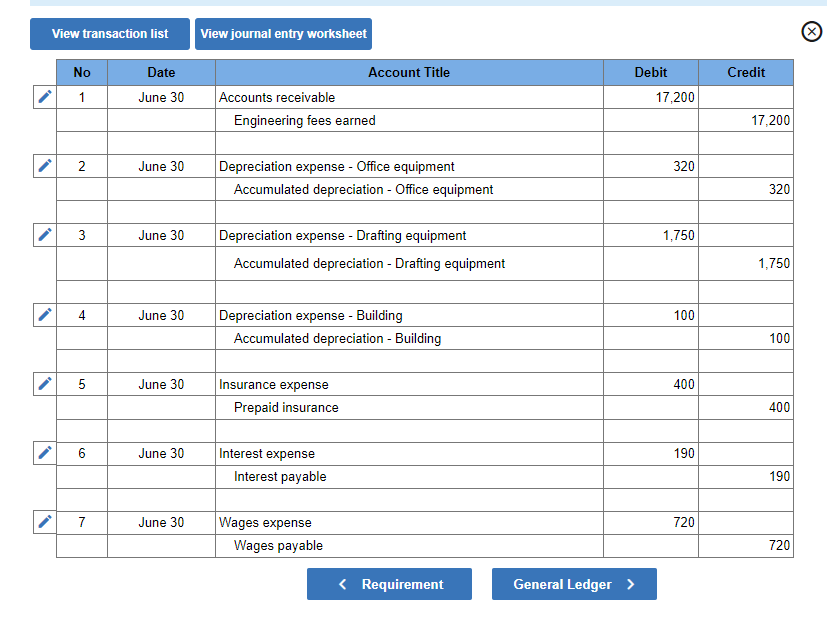

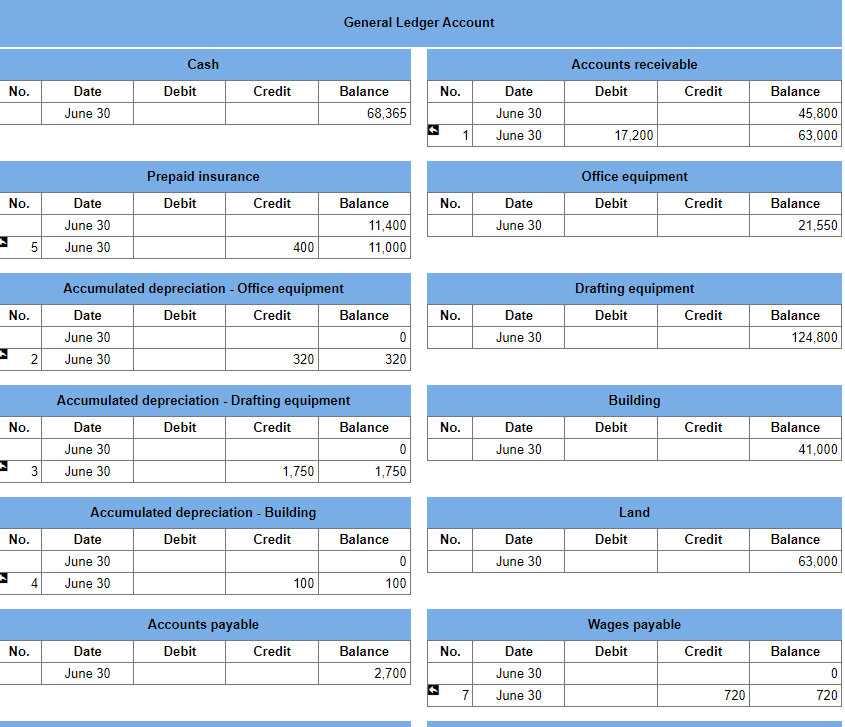

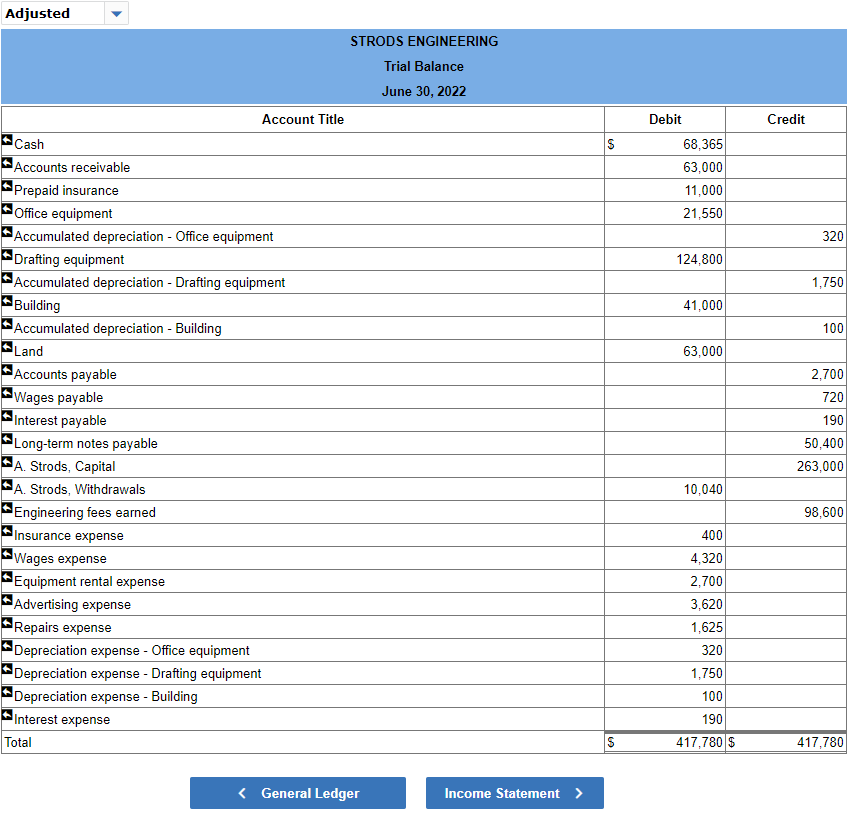

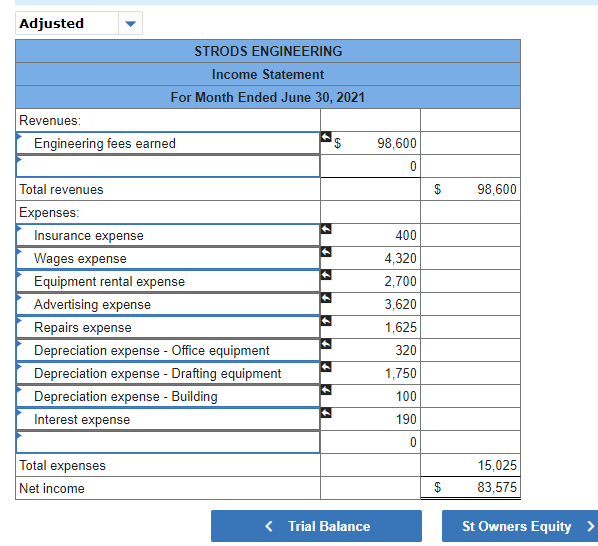

Descriptions of items that require adjusting entries on June 30, 2021, follow.

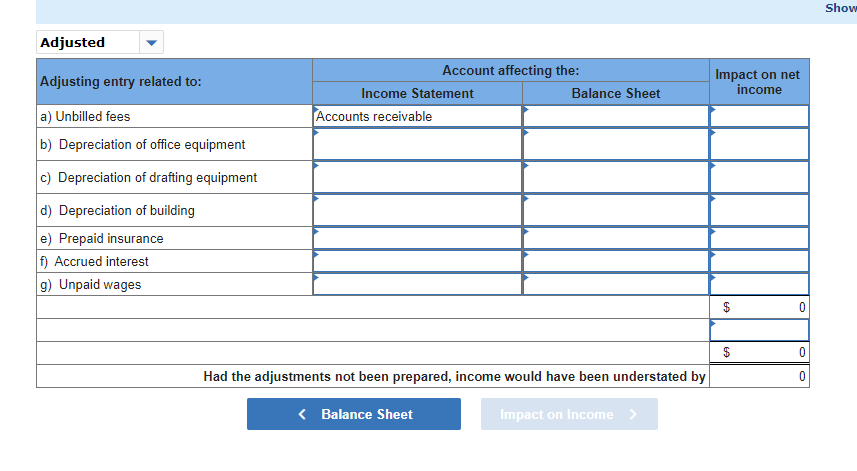

a) The company has completed, but not yet billed, $17,200 of engineering services for a client.

b) Straight-line depreciation on the office equipment, assuming a 5-year life and a $2,350 salvage value, is $320 per month.

c) Straight-line depreciation on the drafting equipment, assuming a 5-year life and a $19,800 salvage value, is $1,750 per month.

d) Straight-line depreciation on the building, assuming a 25-year life and a $11,000 salvage value, is $100 per month.

e) The balance in prepaid insurance represents a 15-month policy that went into effect on June 1.

f) Accrued interest on the long-term note payable is $190.

g) The drafting assistant is paid $1,800 for a 5-day work week. 2 days' wages have been incurred but are unpaid as of month-end.

View transaction list View journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts