Question: A study has been conducted to determine if Product A should be dropped. Sales of the product total $400,000 per year; variable expenses total $270,000

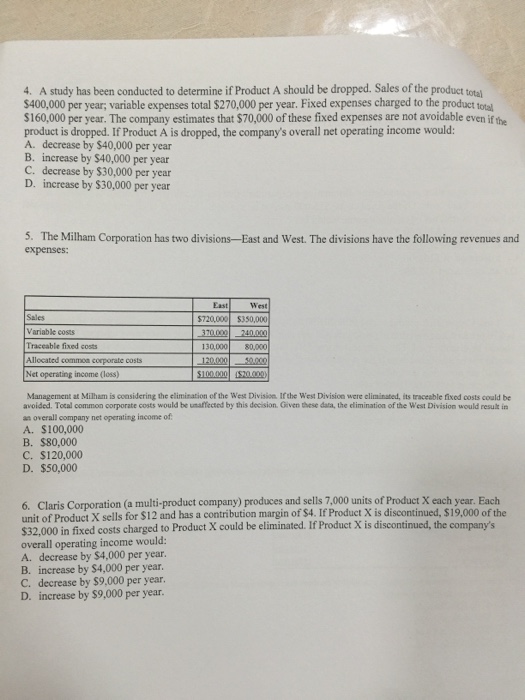

A study has been conducted to determine if Product A should be dropped. Sales of the product total $400,000 per year; variable expenses total $270,000 per year. Fixed expenses charged to the product total S 160.000 per year. The company estimates that $70,000 of these fixed expenses are not avoidable even if the product is dropped. If Product A is dropped, the company's overall net operating income would: A.decrease by $40,000 per year B.increase by $40,000 per year C.decrease by $30,000 pcr'year D.increase by S30.000 per year5. The Milham Corporation has two divisions-East and West. The divisions have the following revenues and expenses: Management it Milhun is considering the of the West Division of Division we d. its traceable fixed costs could be avoided Total common costs would be unaffected by this decision given these data, the diminution of the West Division would result in an overall company net operating income of A.S100,000 B.$80,000 C.$120,000 D.$50,000 6 Claris Corporation (a multi-product company) produces and sells 7,000 units of Product X each year. Each unit of Product X sells for $12 and has a contribution margin of $4. If Product X is discontinued, $19,000 of the $32,000 in fixed costs charged to Product X could be eliminated. If Product X is discontinued, the company's overall operating income would: A.decrease by $4,000 per year. B.increase by $4.000 per year. C.decrease by $9.000 per year. D.increase by $9,000 per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts