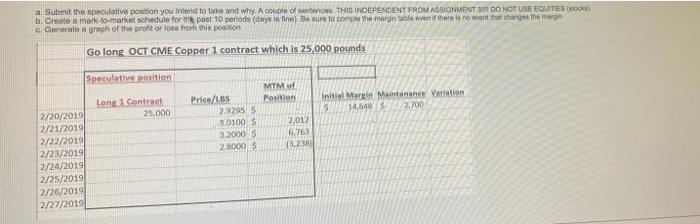

Question: a. Submit the speculative position you intend to take and why A couple of sentences. THIS INDEPENDENT FROM ASSIGNMENT 3 DO NOT USE EQUITES (stock)

a. Submit the speculative position you intend to take and why A couple of sentences. THIS INDEPENDENT FROM ASSIGNMENT 3 DO NOT USE EQUITES (stock) b. Create a mark-to-market schedule for the past 10 periods (days is fine). Be sure to comple the margin table even if there is no event that changes the margin c. Generate a graph of the profit or loss from this position Go long OCT CME Copper 1 contract which is 25,000 pounds Speculative position MTM of Long 1 Contract Price/LBS Position Initial Margin Maintanance Variation 15 2.700 14,648 5 2/20/2019 2/21/2019 2/22/2019 2/23/2019 2/24/2019 2/25/2019 2/26/2019 2/27/2019 25,000 2.9295 S 3.0100 $ 3.2000 S 2.8000 $ 2,012 6,763 (3,238) Step 3 - Hedger Mark to Market 200pts Submit for the corporation you've chosen: a. the exposure they have, and what research or rationale led you to that conclusion (a paragraph NO MORE). b. Create a mark-to-market schedule for the past 10 periods (days is fine). This link is for step by step guide to Assignment 3 & 4 - Here's a link to "Steps 3 & 4 Video.mov" in my Dropbox: a. Submit the speculative position you intend to take and why A couple of sentences. THIS INDEPENDENT FROM ASSIGNMENT 3 DO NOT USE EQUITES (stock) b. Create a mark-to-market schedule for the past 10 periods (days is fine). Be sure to comple the margin table even if there is no event that changes the margin c. Generate a graph of the profit or loss from this position Go long OCT CME Copper 1 contract which is 25,000 pounds Speculative position MTM of Long 1 Contract Price/LBS Position Initial Margin Maintanance Variation 15 2.700 14,648 5 2/20/2019 2/21/2019 2/22/2019 2/23/2019 2/24/2019 2/25/2019 2/26/2019 2/27/2019 25,000 2.9295 S 3.0100 $ 3.2000 S 2.8000 $ 2,012 6,763 (3,238) Step 3 - Hedger Mark to Market 200pts Submit for the corporation you've chosen: a. the exposure they have, and what research or rationale led you to that conclusion (a paragraph NO MORE). b. Create a mark-to-market schedule for the past 10 periods (days is fine). This link is for step by step guide to Assignment 3 & 4 - Here's a link to "Steps 3 & 4 Video.mov" in my Dropbox

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts