Question: A subsidiary provided services to its parent during the current year, at a cost of $120,000. The subsidiary charged the parent $200,000 for the services.

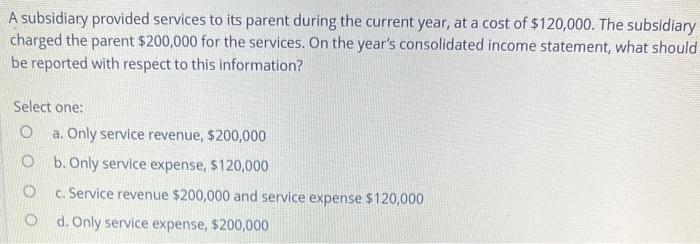

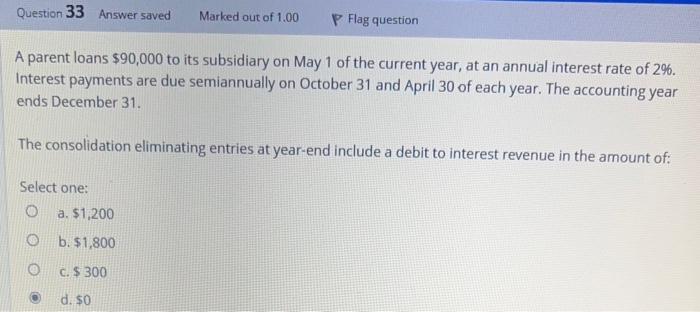

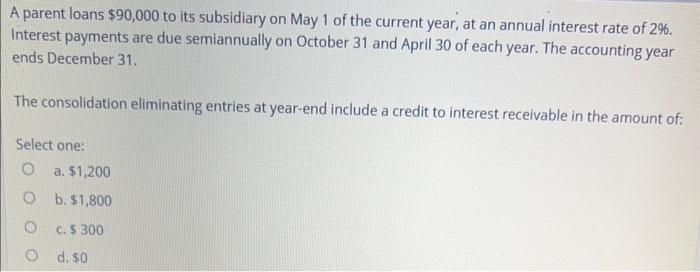

A subsidiary provided services to its parent during the current year, at a cost of $120,000. The subsidiary charged the parent $200,000 for the services. On the year's consolidated income statement, what should be reported with respect to this information? Select one: a. Only service revenue, $200,000 b. Only service expense, $120,000 c. Service revenue $200,000 and service expense $120,000 d. Only service expense, $200,000 A parent loans $90,000 to its subsidiary on May 1 of the current year, at an annual interest rate of 2%. Interest payments are due semiannually on October 31 and April 30 of each year. The accounting year ends December 31 . The consolidation eliminating entries at year-end include a debit to interest revenue in the amount of: Select one: a. $1,200 b. $1,800 c. $300 d. $0 A parent loans $90,000 to its subsidiary on May 1 of the current year, at an annual interest rate of 2%. Interest payments are due semiannually on October 31 and April 30 of each year. The accounting year ends December 31. The consolidation eliminating entries at year-end include a credit to interest receivable in the amount of: Select one: a. $1,200 b. $1,800 c. $300 d. $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts