Question: A) Summary Report Type your report in the box below. Comparing your calculations from alternative 1 and alternative 2 - which alternative do you

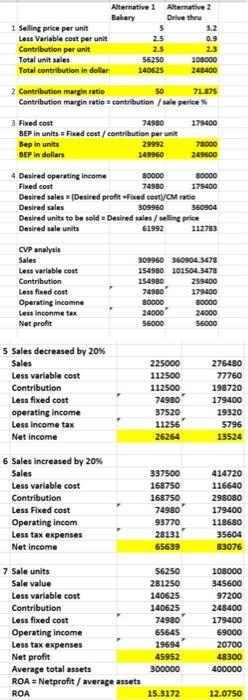

A) Summary Report – Type your report in the box below. Comparing your calculations from alternative 1 and alternative 2 - which alternative do you recommend to Nathan and Cody? Why? The company can only pick one of the alternatives, due to the time and resources involved, so you will need to make a compelling case to support your decision. Be sure to identify any assumptions used in your analysis. If you use any outside sources, be sure to include a works cited page. Your summary report will need to state your choice for either alternative 1 OR 2. The report needs to be typed and be 2 pages double spaced and must include financial analysis from Part A.

ACCT 102 Case Project Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great coffee from all over the world to their local community. Together they have formed Classic Coffee Company, or CCC (assume their coffee shop is located a few miles from our college campus). Nathan is selecting and making the coffee they serve. Cody manages the front and back office; selling coffee to customers, paying employees, and running ads for the coffee shop. Last year, the company sold 45,000 units and had the below sales and cost figures. Sales $135,000.00 $ 40,500.00 Variable Costs Contribution Margin $ 94,500.00 Fixed Costs $ 49.980.00 Income Before Taxes $ 44,520.00 Income Tax $ 13,356.00 $31.164.00 Net Income The team have been in business for a year. With competition rising in the coffee industry, they know that another challenging and competitive year lies ahead of them. They are considering two alternatives and have hired you to help them make some important business decisions. ACCT 102 Case Project Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great coffee from all over the world to their local community. Together they have formed Classic Coffee Company, or CCC (assume their coffee shop is located a few miles from our college campus). Nathan is selecting and making the coffee they serve. Cody manages the front and back office; selling coffee to customers, paying employees, and running ads for the coffee shop. Last year, the company sold 45,000 units and had the below sales and cost figures. Sales $135,000.00 $ 40,500.00 Variable Costs Contribution Margin $ 94,500.00 Fixed Costs $ 49.980.00 Income Before Taxes $ 44,520.00 Income Tax $ 13,356.00 $31.164.00 Net Income The team have been in business for a year. With competition rising in the coffee industry, they know that another challenging and competitive year lies ahead of them. They are considering two alternatives and have hired you to help them make some important business decisions. ACCT 102 Case Project Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great coffee from all over the world to their local community. Together they have formed Classic Coffee Company, or CCC (assume their coffee shop is located a few miles from our college campus). Nathan is selecting and making the coffee they serve. Cody manages the front and back office; selling coffee to customers, paying employees, and running ads for the coffee shop. Last year, the company sold 45,000 units and had the below sales and cost figures. Sales $135,000.00 $ 40,500.00 Variable Costs Contribution Margin $ 94,500.00 Fixed Costs $ 49.980.00 Income Before Taxes $ 44,520.00 Income Tax $ 13,356.00 $31.164.00 Net Income The team have been in business for a year. With competition rising in the coffee industry, they know that another challenging and competitive year lies ahead of them. They are considering two alternatives and have hired you to help them make some important business decisions.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Summary Report Recommendation Between Alternative 1 Bakery and Alternative 2 DriveThru After thorough financial analysis of both proposed alternatives for Classic Coffee Company CCC Alternative 1 Bake... View full answer

Get step-by-step solutions from verified subject matter experts