Question: (a) Suppose a trader sells a derivative based on the price of a risky asset (S(O)ro. The risky asset is supposed to provide a continuous

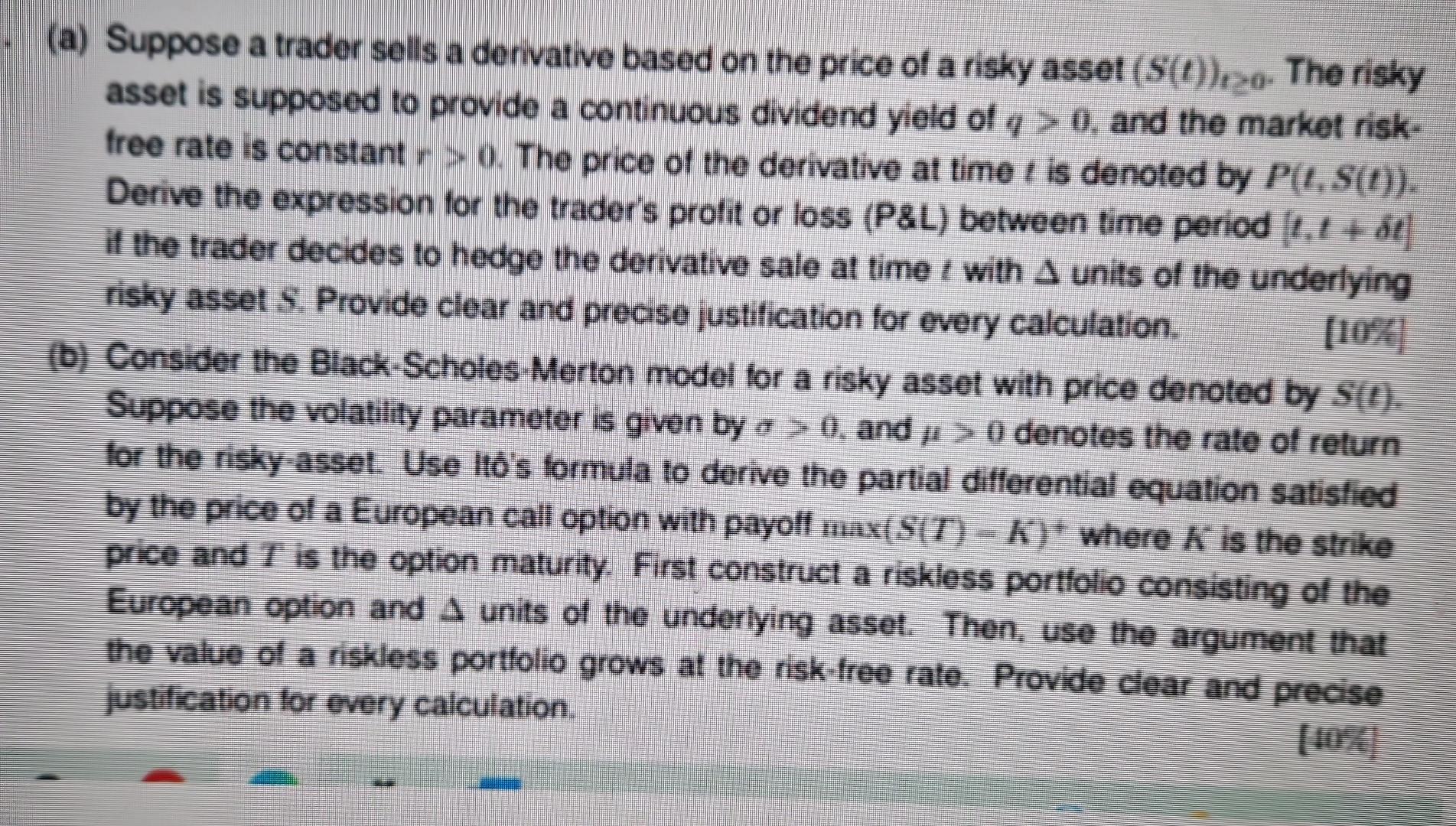

(a) Suppose a trader sells a derivative based on the price of a risky asset (S(O)ro. The risky asset is supposed to provide a continuous dividend yield of 4 > 0, and the market risk- free rate is constant r > 0. The price of the derivative at time I is denoted by P(L. S(2)). Derive the expression for the trader's profit or loss (P&L) between time period (1.t + t if the trader decides to hedge the derivative sale at time with A units of the underlying risky asset S Provide clear and precise ustification for every calculation (b) Consider the Black-Scholes. Merton model for a risky asset with price denoted by S(). Suppose the volatility parameter is gven by 0 and > 0 denotes the rate of return for the risky asset Use Ito's formula to derive the partial differential equation satisfied by the price of a European call option with payoli max(S(T) - k) where K is the strike price and T is the option maturity. First construct a riskless portfolio consisting of the European option and A units of the underlying asset. Then, use the argument that the value of a riskless portfolio grows at the risk-free rate. Provide clear and precise justification for every calculation, (a) Suppose a trader sells a derivative based on the price of a risky asset (S(O)ro. The risky asset is supposed to provide a continuous dividend yield of 4 > 0, and the market risk- free rate is constant r > 0. The price of the derivative at time I is denoted by P(L. S(2)). Derive the expression for the trader's profit or loss (P&L) between time period (1.t + t if the trader decides to hedge the derivative sale at time with A units of the underlying risky asset S Provide clear and precise ustification for every calculation (b) Consider the Black-Scholes. Merton model for a risky asset with price denoted by S(). Suppose the volatility parameter is gven by 0 and > 0 denotes the rate of return for the risky asset Use Ito's formula to derive the partial differential equation satisfied by the price of a European call option with payoli max(S(T) - k) where K is the strike price and T is the option maturity. First construct a riskless portfolio consisting of the European option and A units of the underlying asset. Then, use the argument that the value of a riskless portfolio grows at the risk-free rate. Provide clear and precise justification for every calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts