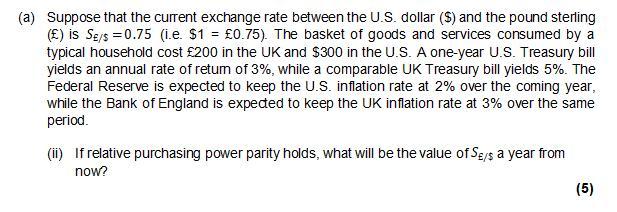

Question: (a) Suppose that the current exchange rate between the U.S. dollar ($) and the pound sterling () is Se/s = 0.75 (i.e. $1 = 0.75).

(a) Suppose that the current exchange rate between the U.S. dollar ($) and the pound sterling () is Se/s = 0.75 (i.e. $1 = 0.75). The basket of goods and services consumed by a typical household cost 200 in the UK and $300 in the U.S. A one-year U.S. Treasury bill yields an annual rate of retum of 3%, while a comparable UK Treasury bill yields 5%. The Federal Reserve is expected to keep the U.S. inflation rate at 2% over the coming year, while the Bank of England is expected to keep the UK inflation rate at 3% over the same period. (ii) If relative purchasing power parity holds, what will be the value of Se/s a year from now? (5) (a) Suppose that the current exchange rate between the U.S. dollar ($) and the pound sterling () is Se/s = 0.75 (i.e. $1 = 0.75). The basket of goods and services consumed by a typical household cost 200 in the UK and $300 in the U.S. A one-year U.S. Treasury bill yields an annual rate of retum of 3%, while a comparable UK Treasury bill yields 5%. The Federal Reserve is expected to keep the U.S. inflation rate at 2% over the coming year, while the Bank of England is expected to keep the UK inflation rate at 3% over the same period. (ii) If relative purchasing power parity holds, what will be the value of Se/s a year from now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts