Question: A swap is: choose the correct answer a. allows a firm to convert outstanding fixed rate debt to floating rate debt. b. obligates two counterparties

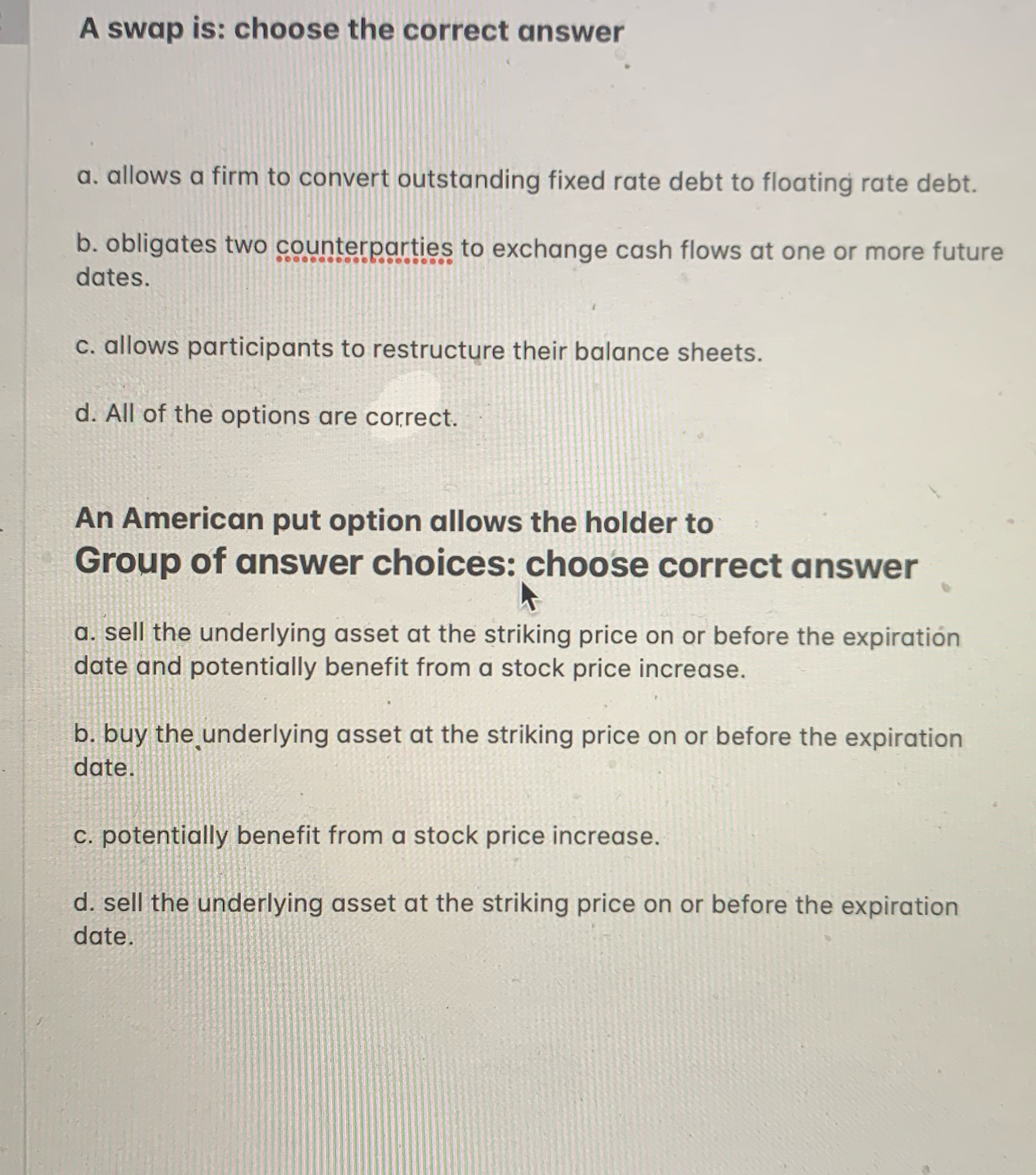

A swap is: choose the correct answer a. allows a firm to convert outstanding fixed rate debt to floating rate debt. b. obligates two counterparties to exchange cash flows at one or more future dates. c. allows participants to restructure their balance sheets. d. All of the options are correct. An American put option allows the holder to Group of answer choices: choose correct answer a. sell the underlying asset at the striking price on or before the expiration date and potentially benefit from a stock price increase. b. buy the underlying asset at the striking price on or before the expiration date. c. potentially benefit from a stock price increase. d. sell the underlying asset at the striking price on or before the expiration date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts