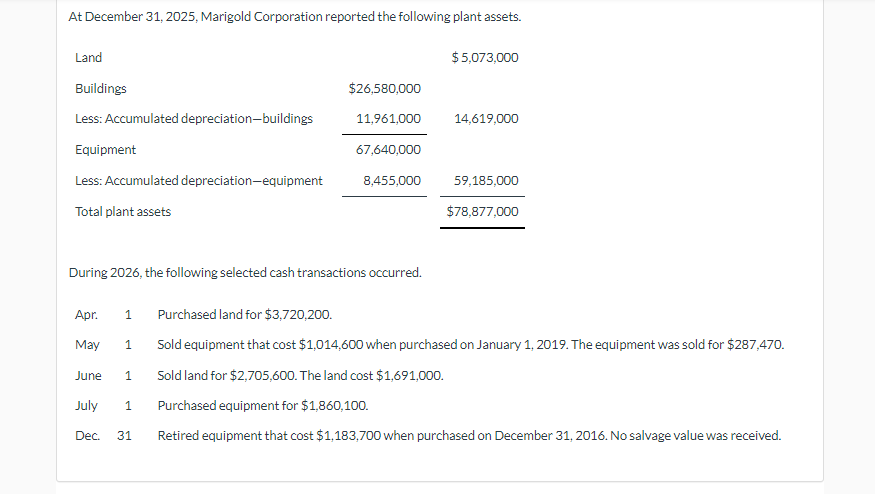

Question: A t December 3 1 , 2 0 2 5 , Marigold Corporation reported the following plant assets. Dep During 2 0 2 6 ,

December Marigold Corporation reported the following plant assets. Dep

During the following selected cash transactions occurred.

Apr. Purchased land for $

May Sold equipment that cost $ when purchased January The equipment was sold for $

June Sold land for $ The land cost $

July Purchased equipment for $

Dec. Retired equipment that cost $ when purchased December salvage value was received.

Your answer correct.

Journalize the transactions. You may wish set accounts, post beginning balances, and then post transactions.

Marigold uses straightline depreciation for buildings and equipment. The buildings are estimated have year useful life

and salvage value; the equipment estimated have year useful life and salvage value Update depreciation

assets disposed the time sale all debit entries before credit entries. Record entries the order displayed

the problem statement Credit account titles are automatically indented when amount entered. not indent manually. entry

required, select Entry" for the account tities and enter for the amounts.

ate

quad

quad

record depreciation equipment sold

record sale equipment

Account Titles and Explanation

Cash

Cash

Depreciation Expense

Accumulated Deprecation Equipment

record depreciation equipment retired

Accumulated Depreciation Equipment

Credit

record disposal equipment

Record adjusting entries for depreciation for debit entry before credit entry. Credit account titles are automatically indented

when amount entered not indent manually. entry required, select Entry" for the account titles and enter for the

amounts.

Account Titles and Explanation

Credit

Depreciation Expense

Accumulated DepreciationBuildings

record depreciation buildings

Depreciation Expense

record depreciation equipment

December Marigold Corporation reported the following plant assets.

During the following selected cash transactions occurred.

Apr. Purchased land for $

May Sold equipment that cost $ when purchased January The equipment was sold for $

June Sold land for $ The land cost $

July Purchased equipment for $

Dec. Retired equipment that cost $ when purchased December salvage value was received. Your answer correct.

Journalize the trangactions. You may wish set accounts, post bezinning balances, and then post transactions.

Marigold uses straightline depreciation for buildings and equipment. The buildings are astimated have year usefull life

and salvage value; the equipment estimatad havea year useful life and salvage value Update depreciation

assets disposed the time sale ratirament. all debit entries before credit entries. Record entries the order displayed

the problem statement Credit account tities are automatically indented when amount entered. not indent manually. entry

required, select Entry" for the account tities and enter for the amounts.

ate

record depraciation equipment sold

record sale equipment

Account Titles and Explanation

Cash

Cash

Dagraciation Exgansa

Accumulatad DagraslationEquibment

record depreciation equipment retired

Aceumulatad DagrastationrEquibmant

Credit

racard disposal equipment

Record adjusting entriss for dapraciation for debit entry before credit entry. Credit account titles are automatically indented

when amount entered not indent manually. entry required, select Entry" for the account titles and enter for the

amounts.

Account Titles and Explanation

Credit

Degraclation Exgense

Aceumulatad DegraclationBulldives

record depreciation buildings

Degraclation Exgense

record depreciation equipment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock