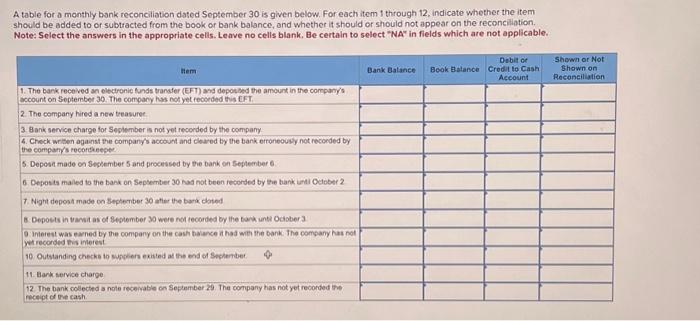

Question: A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be

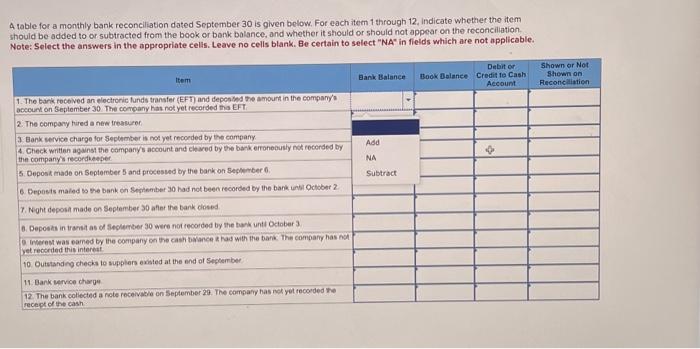

A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12 , indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. Note: Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable. A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be added to or subtracted from the beok or bonk balance, and whether it should or should not appear on the reconciliation Note: Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable. A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12 , indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. Note: Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable. A table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be added to or subtracted from the beok or bonk balance, and whether it should or should not appear on the reconciliation Note: Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts