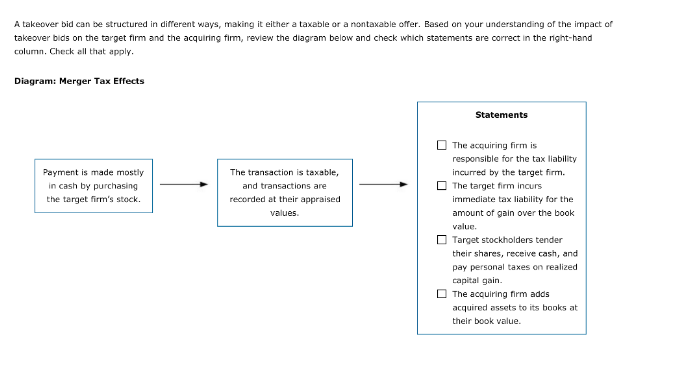

Question: A takeover bid can be structured in different ways, making it either a taxable or a montaxable offer. Based on your understanding of the impact

A takeover bid can be structured in different ways, making it either a taxable or a montaxable offer. Based on your understanding of the impact of takeover bids on the target firm and the acquiring firm, review the diagram below and check which statements are correct in the night-hand column. Check all that apply. Diagram: Merger Tax Effects Statements Payment is made mostly in cash by purchasing the target firm's stock. The transaction is taxable, and transactions are recorded at their appraised values. The acquiring firm is responsible for the tax liability incurred by the target firm. The target firm incurs immediate tax liability for the amount of gain over the book value. Target stockholders tender their shares, receive cash, and pay personal taxes on realized capital gain The acquiring firm adds acquired assets to its books at their book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts