Question: A tax practilioner can avoid IRS penalty relating to a tax return position: Multiple Choice For the position is flivelous and disclosed on the tax

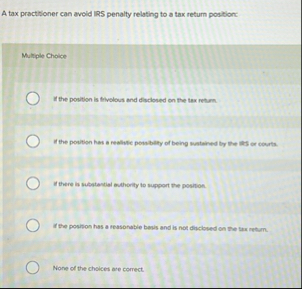

A tax practilioner can avoid IRS penalty relating to a tax return position:

Multiple Choice

For the position is flivelous and disclosed on the tax return.

the position has a realiste possiblity of being sustained by the ills or courts.

there is substantial authority to support the position.

If the position has a reasonable basis and is not dicclosed on the tax retur.

None of the choices are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock