Question: A taxable temporary difference is one that will result in: Select one: O a. taxable amounts in determining taxable profits/tax loss of the current reporting

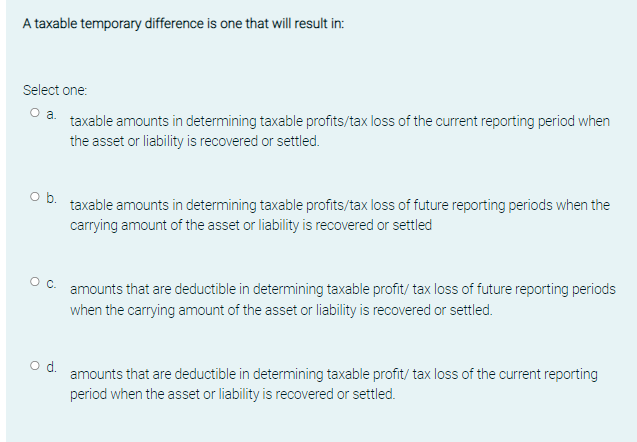

A taxable temporary difference is one that will result in: Select one: O a. taxable amounts in determining taxable profits/tax loss of the current reporting period when the asset or liability is recovered or settled. O b. taxable amounts in determining taxable profits/tax loss of future reporting periods when the carrying amount of the asset or liability is recovered or settled C. amounts that are deductible in determining taxable profit/ tax loss of future reporting periods when the carrying amount of the asset or liability is recovered or settled. Od. amounts that are deductible in determining taxable profit/ tax loss of the current reporting period when the asset or liability is recovered or settled

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts